One metal where demand is soaring is lithium which is used in rechargeable batteries for smartphones, Ipads and electric vehicles. A game changing event occurred this past week when Albemarle (ALB) paid over $6.2 billion to buy the world's largest publicly traded lithium producer Rockwood Holdings (ROC).

This is one of the largest chemical deals and the lithium industries biggest M&A transaction in history. Demand has doubled in the past decade as lithium ion battery use has grown in mobile technology. Growth in the lithium sector has been far outpacing other sectors. Some experts believe demand could even grow faster over the next decade especially as electric vehicles gain market share.

The recent M&A news combined with Tesla's (TSLA) announcement that they will build a "gigafactory" in the southwestern US makes me believe that consumption will soar over the coming decade and domestic lithium assets could rise exponentially in value. Remember each electric vehicle contains more than forty pounds of lithium.

The key for investors is finding potential sources of the raw material in North America. Don't forget the Chinese paid over $625 million for Australia's Talison. I expect further deals to be announced by one of the four major producers such as Talison, Rockwood, SQM and FMC.

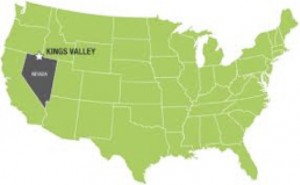

One that we've followed for years and believe could be an acquisition target is Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX). The company's location in Nevada, with one of the most advanced lithium deposits, is very compelling for battery makers.

In addition, Western Lithium is going to be in production shortly, producing hectorite clays used in the fracking industry for deep directional drilling. It is fully permitted for its Hectatone organoclay business. They have raised over $9M showing the market they have the ability to finance. The Hectatone business is looking good for startup in the fall; plans should be complete in the summer.

The lithium demonstration plant is scheduled for launch in Germany at the end of 2014. Western Lithium has two tracks—the Hectatone business for the oil and gas industry, and lithium for Tesla and other electric vehicle makers. Both tracks are moving forward, and in exciting areas.

The recent uptrend is intact and WLC is returning to support at the trendline and the 50% retracement zone of the September through April rally.

See my recent interview with Western Lithium's CEO below...

Disclosure: I am a shareholder of Western Lithium and the company is a website sponsor. Be aware of any conflict of interests. Please do your own due diligence. This is not a solicitation to buy or sell stock. For entertainment purposes only.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend.

To send feedback or to contact me click here...

0 Responses