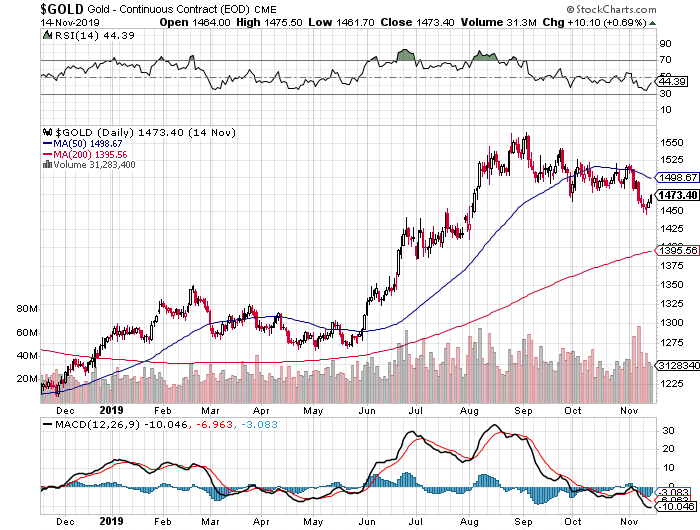

Important chart update on $SLV $GDXJ $GLD $SILJ...nothing to be concerned about...charts are still super bullish. #gold #silver #juniorminers

Read more

Could Nanotechnology Bring Down the Costs of Gold Mining Extraction?

This is where the problem lies with a lot of gold miners. More than 10% of gold mined is lost in this 100 year old cyanide solution using activated carbon. This comes at a huge cost for big producers like Agnico, Kinross and TMAC. A 200k oz/year producer could lose over $26 million annually just lost in cyanide solution and carbon particles.

Read more

Big News Expected in the Gold Miners Before BMO and PDAC

The Junior Gold Miners $GDXJ are holding the 50 DMA and forming a cup and handle. We could see a bounce starting soon. Big news is expected from some junior miners before the annual BMO and PDAC events in early March which are the biggest mining conferences of the year.

Read more

Gold Mining Investors Returning To High Grade in Quebec

Burkina Faso has been battling Islamic terrorists since 2016, thousands are dead and they have driven nearly 500K from their homes, mining operations have been attacked.

I was once bullish but started moving away in 2019 focused on North America. One area that has been our favorite is Quebec especially the established Cadillac Break Trend where more than 75 million ounces of gold have been produced over the past 100 years.

Read more

8 Gold Miners Showing Relative Strength Despite Coronavirus Scare

As the #coronavirus hits global #stockmarkets investors look to #gold and the highest quality #goldminers showing great relative strength on a cloudy day! Files crossing my desk showing flight of quality capital into some gold miners we follow including $FNV $LUG $TGZ $GCM $BTO $YRI $KNT $GTT...all these companies are larger cap situations and not many juniors are participating with the gain in safe haven gold and US treasury bonds.

Read more

GO USA! First New #Copper Mine in USA in 10 Years

his comes at a huge cost. A major legal case has been launched against the largest tech companies such as Apple, Google, Microsoft and Tesla for using child slave labor. Demand for copper and cobalt is soaring but a lot originates from areas with extreme poverty and no labor laws.

Washington DC is seeing a push led by President Trump to boost domestic mineral production, development and exploration for the first time in decades.

Read more

Gold Year End Breakout Finally Boosting Junior Miners $GLD $GDXJ

Several weeks ago when the TSX Venture was on its back due to tax loss selling I warned its planting time not selling time predicting a year end breakout in gold and the junior miners. Now gold has rallied pretty much everyday for 2 straight weeks making it short term overbought after a powerful breakout move into new 7 year highs.

Don't be surprised for a little profit taking along the way as precious metals bulls who have been beaten down for so long are finally able to take some gains as gold is overbought because of the recent instability in Iraq over the killing of the Iranian General by the USA.

Read more

Gold and Palladium Hitting Record Highs on Geopolitical Uncertainty

The chart looks amazing and I can't find any other junior like this. If you can find another palladium junior in North America with these economics please tell me! Its hard to find a project that could average 200k palladium eq. ounces annually over 14 years at an all in sustaining cost under $600 an ounce.

Read more

M&A Activity Sparks The Junior Gold Miners to Make Year End Breakout $GDXJ

Any connection? $spy #usdebt reaching 24 trillion. Every ten trillion equals 1k points on the #sp500?? pic.twitter.com/i10yd19Q1A — Jeb Handwerger (@goldstocktrades) November 12, 2019 Following the Great Financial Crisis in 2008, Governments around the world flooded the banks with cash expanding their balance sheets. Rates were kept artificially low to continue to try to support…

Read more

Junior Mining Investors Waiting for Tax Loss Selling Season To End

Remember the best time to start acquiring juniors is during tax loss selling. Find some juniors beaten down for no good reason that have been publishing great drill results.

Read more