Any connection? $spy #usdebt reaching 24 trillion. Every ten trillion equals 1k points on the #sp500?? pic.twitter.com/i10yd19Q1A

— Jeb Handwerger (@goldstocktrades) November 12, 2019

Following the Great Financial Crisis in 2008, Governments around the world flooded the banks with cash expanding their balance sheets. Rates were kept artificially low to continue to try to support growth. From 2009 to 2015 rates were cheap but then after six years of going higher the Fed decided to attempt to start tightening. For 3 more years they tried to raise rates until the market combined with tariff concerns had it worst December in 2018 and the beginning of a massive rotation into precious metals.

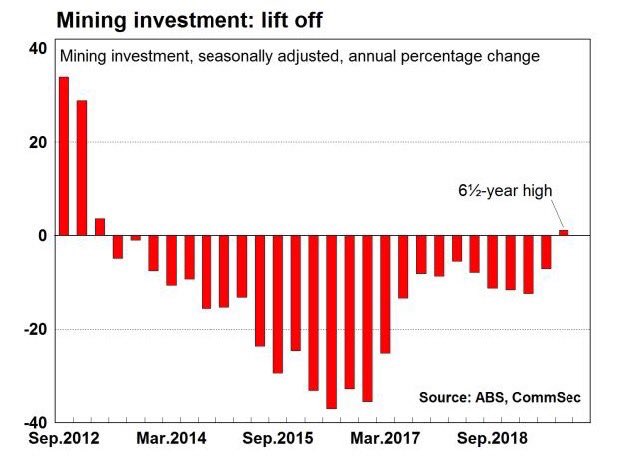

Now this year we saw a record amount of negative yielding debt globally and deposit accounts in Germany are being affected. We also witnessed the inverted yield curve which is a troublesome sign. The global economy is still weak despite these colossal efforts by Bankers. Now the Fed decided to reverse direction and start cutting rates in 2019. Gold has broken out into six year highs and mining investment which was ignored for a decade comes back into favor first led by the Australians who came into North America through companies like Northern Star that bought Pogo in Alaska, South 32 which paid billions for Arizona Mining, St Barbara for Atlantic Gold and now recently Evolution for the Newmont assets.

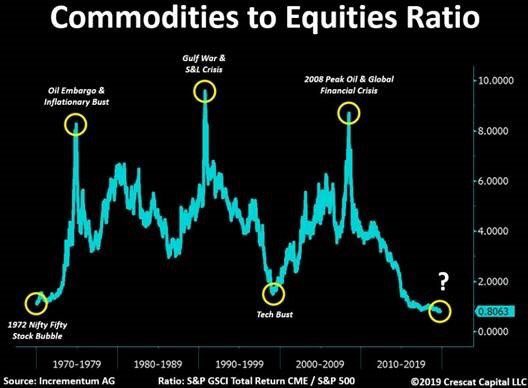

After the Australians made a move then the majors like Barrick and Randgold and Newmont and Goldcorp merged. Recently Kirkland Lake has made a friendly offer for Detour and Zijin just bought Continental in Colombia this week. Osisko made the move for Barkerville in BC recently and Endeavour tried a hostile bid on Centamin. The junior gold miners look like they are breaking out of its 3 month pullback. Notice the recent share consolidations with Victoria and Gold X as companies look to possibly start uplisting to the American Exchanges. All these events above are signs gold is already in a bull market. For over 10 years gold investors have been embarrassed as predictions of painful inflation have largely been masked by a record high US Equity Market led by Tech stocks in the Nasdaq and Large Caps in the S&P500 and a booming real estate market globally.

Notice the recent share consolidations with Victoria and Gold X as companies look to possibly start uplisting to the American Exchanges. All these events above are signs gold is already in a bull market. For over 10 years gold investors have been embarrassed as predictions of painful inflation have largely been masked by a record high US Equity Market led by Tech stocks in the Nasdaq and Large Caps in the S&P500 and a booming real estate market globally.

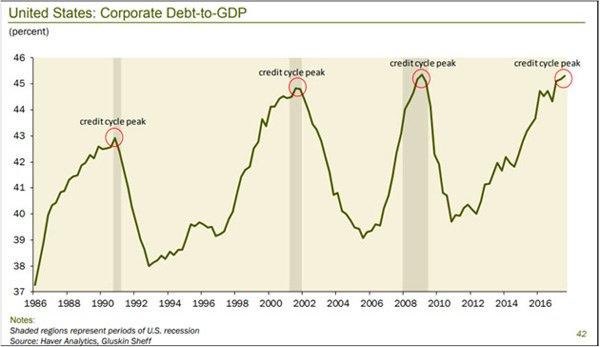

That could be changing now as there are record inflows into the gold mining ETF's. Companies need to build up their market caps and liquidity to qualify. These gold miners need to be more than one trick ponies. Smart investors realize we could be at the top of a credit cycle peak that comes once every ten years. Junior miners and real hard assets will come back into favor when the bubble bursts like it did in crypto and cannabis.

$MMG.v asc/tri-b/o c/s-b/o s/n/r/hi w4f/t ut/b t/u ***a #tsxv #smallcaps #tsx #cdnpennystocks #cdnhotstocks #cdnwolfpack #stocksharks #Trading #DYODD [04Dec2019] pic.twitter.com/l9ysJ94Lep

— ChartTrader (@ChartTrader175) December 4, 2019

$AAG.V @AftermathSilver backed by #ericsprott #highgradesilver project in #chile where drilling is about to start acquired at discount from distressed producer. #cupandhandle breakout! pic.twitter.com/iPRPmU7TV1

— Jeb Handwerger (@goldstocktrades) November 25, 2019

Make sure to sign up to my free email and follow me @goldstocktrades

Assume Author (Jeb Handwerger) owns shares and that I want to sell them for a profit. I may have received or intend to receive compensation for digital marketing services from these companies. The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Jeb Handwerger about any company, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. Author is not responsible under any circumstances for investment actions taken by the reader. Author has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. Author is not directly employed by any company, group, organization, party or person. The shares of these companies are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. Author is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Author is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Author is not an expert in any company, industry sector or investment topic.