(Originally Published and sent to Premium Subscribers (6-2-16) I added some pictures and made a few edits as well.)

It appears the Junior Gold Miners are giving the investment community a

secondary buy point on the now ascending long term moving averages as they

bounce off and find support at these critical technical levels at the 50

and 200 Day Moving Averages. I thought we could still be a few weeks away

from a bullish reversal but it appears some of our featured sponsors and

shareholding are breaking out.

Focus on advanced stage companies which are working towards a Bankable

Feasibility Study. Learn from the recent takeover of Kaminak (KAM.V) by

Goldcorp as they acquired the company after the release of a Feasibility

Study earlier this year for a huge premium. The recent improvement of gold

prices has turned the heads of the majors who may have increasing cash

reserves and may begin turning a profit.

The industry needs to replace depleting reserves as we move towards a gold

production shortfall over the next 18-36 months. Companies with the

ability to raise capital and that are currently advancing towards a

Bankable Feasibility such as Sandspring (SSP.V or SSPXF) and Treasury

Metals (TML.TO) should be on your radar.

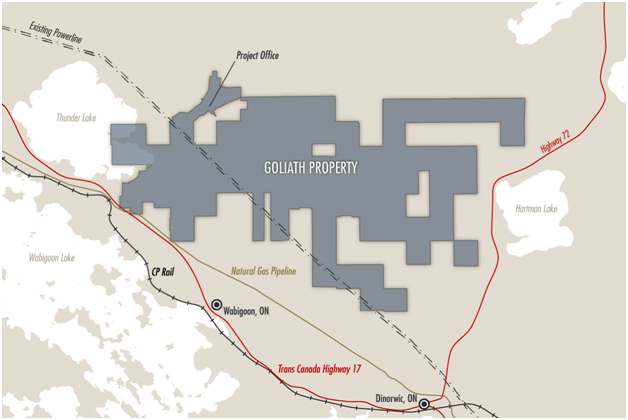

Treasury Metals (TML.TO) just raised $4 million CAD to advance their 100%

owned Goliath Gold Deposit to Bankable Feasibility which I participated in.

Its located in NW Ontario which has seen a major uptick in M&A activity

since the Goldcorp (GG) takeover of Probe. There are very few high grade,

advanced and 100% owned gold assets left in Ontario. Treasury has started

the permitting process of an open pit gold mine which could process 2500

tons of ore per day. I am sure many astute investors are excited to see

the Feasibility Study which could show a low capex and exciting economics.

The Chairman of Treasury is Marc Henderson who is an experienced hand at

negotiating takeouts. He sold his Aquiline Resources to Pan American

Silver in 2009 for over $600 million USD. Treasury appears to be basing

along the 200 Day Moving Average and should see a bullish reversal.

Take a look at this video on Treasury entitled "Canada's Next Gold Mine" by

clicking on the following link:

http://www.treasurymetals.com/s/corporate_video.asp

Sandspring Resources (SSP.V or SSPXF) also has recently raised $6.5 million

CAD this past month which I participated in. Similar to Treasury they are

advancing towards a Feasibility Study on it Toroparu Gold Project in

Guyana. It is one of the world's largest undeveloped gold assets 100%

owned by a junior. The company has a pre-feasibility study which shows

that the project could produce over 200k ounces annually with economics

that shows possibly great leverage to a rising gold price as this project

may have district scale potential.

Some may be concerned about Guyana versus where they traditionally invest

in Nevada or Canada. Most people are unaware that Guyana is the only

English speaking country in South America with a stable democracy, high

literacy rate and a long history of mining. Two new major gold projects

have advanced to production in the past year as mining is vital aspect of

the economy. Sandspring's management has more than 16 years of experience

working with the Guyanese Government.

Sandspring could bounce off the 50 Day Moving Average which could be a

secondary buypoint.

Take a look at their corporate presentation by clicking on the following

link:

http://www.sandspringresources.com/i/pdf/ppt/ssp_PPT_May2016.pdf

Watch the recent presentation given by the CEO in Vancouver where he discusses

the recent investment into the company by their large shareholder and director

the famous Frank Giustra. Back in 2007, Frank sold his company to Uranium One

for over $7 a share that was trading for just pennies two years earlier creating

a lot of wealth for his shareholders. Maybe Sandspring could be next?

Disclosure: I own Treasury and Sandspring securities and participated in both of their recent Private Placements. This means I could benefit from an increase in price and volume. They are also advertising sponsors on my website which should be considered paid compensation. This means I have a conflict of interest and you must do your own due diligence. I am not a

financial advisor and this is not financial advice.

See full disclaimer and current advertising rates by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Section 17(b) provides that: “It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.”

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.