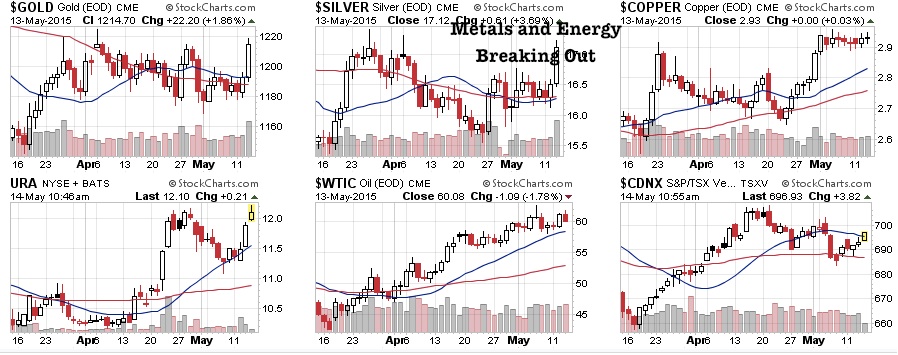

It is possible we are once again at or near the turning point or bottom in the junior mining sector and near a top in the tech sector. Only a handful of the tech high flyers have pushed the equities higher. Already the transports and utilities have been under-performing. It may be wise to hedge gains made in the S&P500 and Nasdaq and increase accumulation of precious metals and the junior miners near historic lows. July 24, 2015 may have marked an interim low on the GDXJ as it experienced a classic bullish engulfing reversal pattern on high volume. Since this past Monday, support has come into some of our selected miners. If its the beginning of the rally, follow through should occur by the end of this week. I am still cautious as the precious metals rallies have been fake outs in the past. In order to confirm the interim low I would like to see some increased buying before the end of this week.

Read more

Ready For The New Bull Market in The Junior Mining Sector?