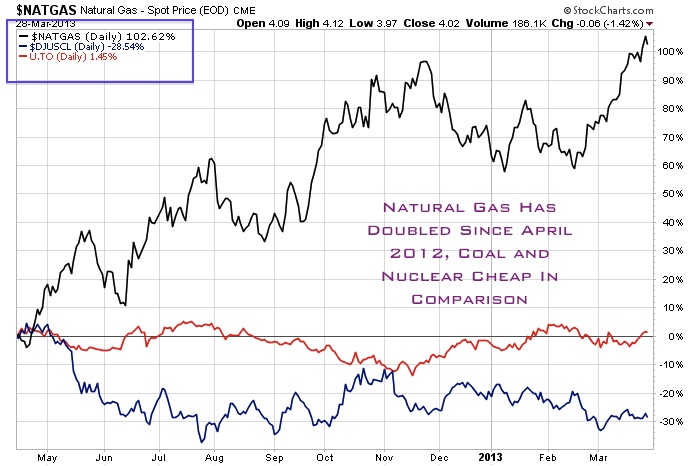

I have recently written about a potential rebound in coal. It is a hated sector by fellow analysts and the investment community as the consensus believes that coal is dead. Hardly anyone covers this sector right now, which provides astute investors with discounted situations. Incidentally, a Barron's article highlighted the insider buying in the coal sector at a time of extreme negative pessimism. This could indicate a bottom for the coal sector.

Read more

Insider Buying May Indicate A Comeback For Coal Stocks