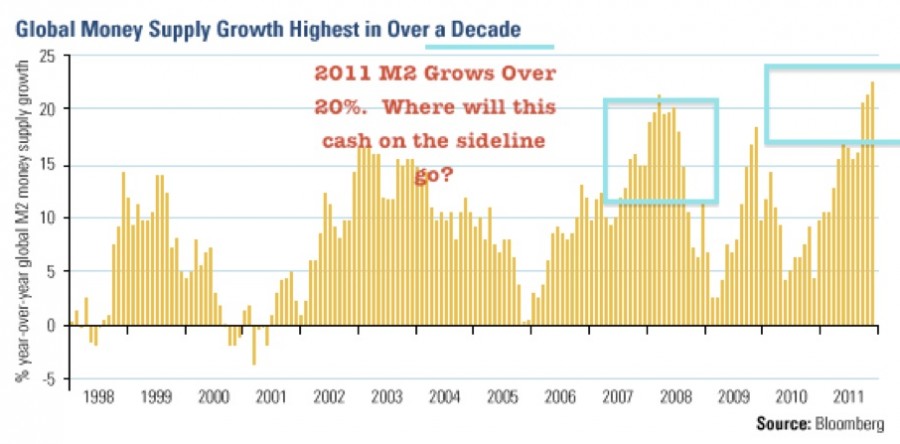

The Fed may follow China and other countries around the globe in making accommodative moves. This summer China began cutting interest rates for the first time in years. Do not forget two years ago at the end of August, Bernanke announced QE2, flooding the markets with $600 billion. Silver soared from $18 to $50. It seems that investors have already prepared for such a move as gold and silver stage technical breakouts, while the miners are just beginning to play catch up. In this article we highlight a potential takeout target which has shown incredible resource growth.

Read more

Investors Preparing For QE3 As Gold and Silver Skyrocket