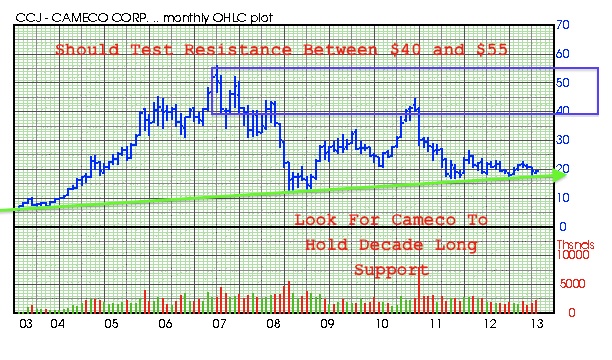

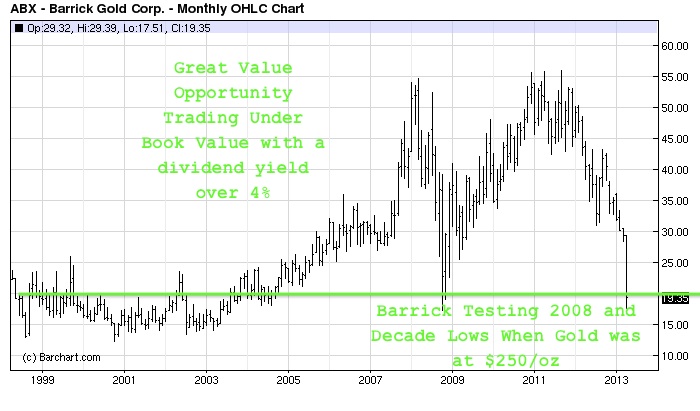

Recent waterfall declines in gold and silver below 5 year trailing moving averages and hitting historic oversold valuations are indicative of a major once in a generation bottom. We are hitting thirty year lows in the resource arena. Eventually, the precious metals sector will turn back higher and hit new inflation adjusted highs. Look for a break above the 50 day moving average which on the GLD is right now $129.08 and on the SLV at $20.40.

Read more

Turning Point In Precious Metals and Miners?