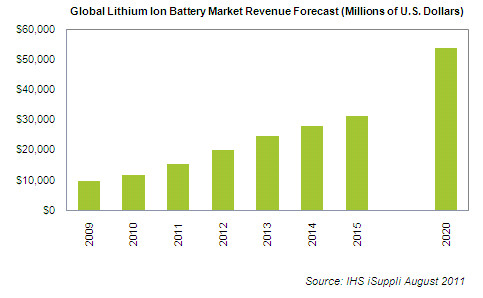

Despite gold correcting, major investment interest increases for the lithium ion battery market which is growing at a breathtaking pace. Demand could double over the next decade as the US is now developing a lithium battery supply chain which could emerge over the coming years.

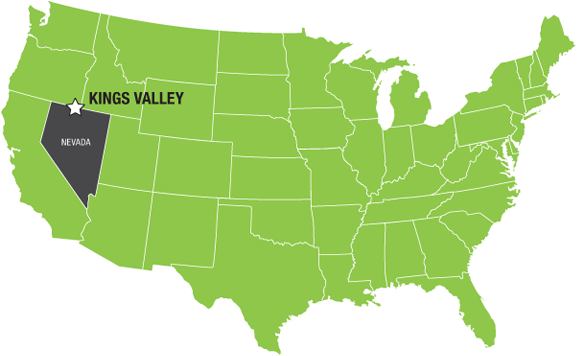

The bellwether leader in the sector Tesla (TSLA) and Samsung (SSLNF) have already committed to building a $5 billion Battery Factory near Reno, Nevada.

For years I have told you that Western Lithium (WLC.TO or WLCDF) could be the major source of lithium for the electric batteries used in cars and smart grids. Western Lithium owns the Kings Valley Lithium Deposit in northern Nevada which is one of the largest assets in the world of this critical resource.

Western Lithium recently released an important development on the lithium processing. They produced 99.8% high quality lithium carbonate in the first trial run at its demonstration plant. This could cause major interest from potential strategic partners who have already expressed interest to partner with the company to accelerate development of the asset. These end users need a domestic and secure supply.

Western Lithium’s CEO Jay Chmelauskas said, “...The lithium market now appears ready for Western Lithium to accelerate the development of its Nevada lithium deposit as a new major supply source. Nevada is emerging as the world’s largest lithium battery manufacturing center and provides potential synergies for Western Lithium to establish its business locally and to become integrated with the global battery supply chain.”

See the full news release on the lithium carbonate produced at their demo plant by clicking here...

I believe the lithium ion battery market especially in Nevada could be an area of strength in 2015 as it was the past two years. Western Lithium could be swallowed up by a larger entity as it is worth only $70 million. Remember that number is a small fraction of the $5 billion price tag that Tesla and Samsung will be shelling out to build this gigafactory.

Lithium is a key ingredient to batteries and Western Lithium owns the major US deposit. Tesla may be a household name right now but don’t be surprised to see Western Lithium discussed at dinner parties after it partners with a major end user possibly this year.

The chart on Western Lithium is excellent over the past two years and appears to be forming a classic bullish flag. Another round of accumulation like we saw in 2014 could be on the agenda. The base is almost one year in the making. The stock is just beginning to come off the bottom of the flag and breaking over the 200 day moving average. Look for a golden crossover of the 50 and 200 day moving average to confirm the next move higher.

In addition, see my recent article on graphite which is another key material for batteries.

Disclosure: I own Western Lithium and the company is a website sponsor. Please do your own due diligence. For informational purposes only. This is not investment advice.

__________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

0 Responses