I have been forecasting for many months that the majors will begin making acquisitions for high quality junior mining companies. Yesterday, major gold miner Agnico Eagle (AEM) agreed to buy early stage Mexican explorer Cayden Resources (CYD.V) for over $200 million in a friendly takeover deal. Agnico gets Cayden's two gold prospects near Goldcorp (GG). Cayden recently hit some good drill results and they announced some preliminary metallurgy, but it is a long way from being a mine. Personally I am quite surprised at Agnico's move. Cayden always appeared to me to be overvalued.

I could argue that if recent drill results are worth over $200 million than explorers like Corvus and Canamex are significantly undervalued as their results may be much better as the drill results are better and they are in Nevada which is a much better jurisdiction then Mexico. Agnico may be up to something with Goldcorp. Do not forget Agnico outbid Goldcorp for Osisko and now Agnico comes into Goldcorp country in Mexico. Cayden borders Goldcorp in Mexico and seemed a likely Goldcorp takeover candidate. Agnico may be positioning itself for a merger with Goldcorp. It may be safe to say that Cayden is fairly valued at $200 million. With this recent deal I believe some of our featured juniors such as Red Eagle (RD.V or RDEMF) are significantly undervalued.

Read more

Did Tesla Choose Nevada To Be Close To This Junior Lithium Miner Up 450% in Past Year?

For years I have been bullish on the growth of the lithium-ion battery in its use in smartphones, tablets, laptops and electric vehicles. It is becoming the battery of choice as the consumer looks to power up on the go. Weeks ago I wrote about a game changing M&A event that could spark a huge rally in the lithium and graphite sector. When Albermarle (ALB) paid $6.2 billion to buy Rockwood (ROC), the world's largest publicly traded lithium producer, I knew it was only a matter of time before our carefully selected junior miners get noticed by the smart money and large institutional funds. Now our feature graphite miner was just acquired. Is it just a matter of time before our featured lithium miner is taken over?

Read more

Junior Graphite Miner in Mexico Bought Out by Flinders

For many weeks I have been alerting my readers to increased acquisitions in the graphite sector as Tesla announced big plans in the near term to build a gigafactory in North America to increase production of lithium ion batteries for electric vehicles. The announcement of a Tesla Lithium Ion Gigafactory in North America has jumpstarted the junior mining graphite sector as I predicted in this article more than two weeks ago.

In the article, I stated that graphite is a large component of lithium ion batteries. The graphite miners are still undervalued and the M&A boom may be just beginning as there could be a major increase in demand for these batteries critical for cars, smartphones, tablets and laptops. The public is not yet aware about the exponential rise in demand for the lithium-ion battery sector which could more than double over the next ten years.

A few weeks ago, I highlighted an unknown junior graphite miner, who already sold amorphous graphite in Mexico but took a huge leap forward when it acquired a Graphite Mine and Mill in Mexico. It was a past producer but shut down in 2002 when the Chinese knocked down the price of graphite. Now I see across the wires that it was bought out...

Read more

Junior Niobium Miner On Verge Of Major Breakout On High Grade Assays

On April 4th, 2014 I highlighted to my premium subscribers an obscure junior niobium miner which many ignored and was trading at approximately $.26. Right now, the stock is on the verge of its next major breakout at $.80 as it hits the highest grade results to date. The company announced this past week niobium assays in excess of 3% this past week.

Read more

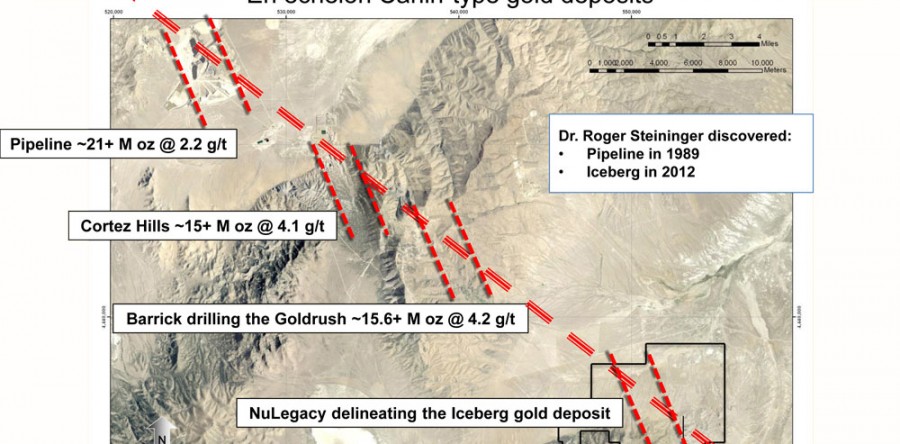

Smart Money Looking at This Junior Miner on the Cortez Trend in Nevada

The Cortez District now hosts Barrick's most profitable mines and exploration growth. Barrick has recently made a huge discovery called Goldrush which is only about a mile from their 1 millon ounce producer Cortez Mine. Goldrush has grown to become a 15.6 million ounce deposit. Barrick is quickly realizing that this district is where it can make the most money and should focus investment on this area. Barrick believes in the future growth of this district and is partnering with juniors such as...

Read more

Summer Doldrums in Junior Gold Miners Ending?

Weeks ago I forecasted black swans on the horizon that will wake investors from their summer doldrums. I warned you about the Russian-Ukraine crisis, the rise of ISIS in Iraq and a potential war between Hamas and Israel. The junior gold miners (GDXJ) and silver miners (SIL) are on the verge of a major reverse head and shoulders breakout. Look for GDXJ to breakout through $46 and the silver miners (SIL) to break through resistance at $14.75. The copper miners (COPX) have made a major rally from $8.60 in March to $11 in July. I expected this pullback before a September Labor Day Rally. I believe the summer doldrums may be ending and we may be on the verge of beginning of a major rally. Investors may want to look into this junior miner which hit 412m of 1.4% copper equivalent in a gold-copper porphyry.

Read more

Lithium and Graphite Sector is Jumpstarting With Investor Interest

Its a very exciting time for the lithium and graphite sector as Tesla announces big plans in the near term. The announcement of a Tesla Lithium Ion Gigafactory in North America has jumpstarted the junior mining graphite and lithium sector as I discussed in this last article more than a month ago. Look at Western Lithium, Northern Graphite, Flinders Resources and Big North Graphite which have all recently made major moves. The lithium and graphite miners are still undervalued and the boom may be just beginning as there could be a major increase in demand for these batteries critical for cars,

Read more

Are The Junior Miners Going To Benefit From Severe Large Cap Correction?

One sign is a huge uptick in volume in the Market Vectors Junior Gold Miners ETF. The volume increase in the first seven months of 2014 has been exceptional, whereas volume is decreasing in a rising market in the SPDR S&P 500 ETF (SPY:NYSE), an ETF tracking the S&P 500. The rising volume in the juniors may indicate accumulation, whereas decreasing volume in a rising market may indicate that the rally in the S&P 500 is overbought and running out of steam. The equity market has not had a significant correction in more than three years and it's dangerous territory for a correction.

Read more

Why This Junior Gold Miner in Nevada Soared 200% in 2014

At the end of 2013, I predicted the junior gold (GDXJ) and silver miners (SIL) would outperform the S&P500 in 2014. I was right so far in 2014. THe GDXJ is up over 36% on the year while the S&P500 is up under 5%. However, one of the junior gold miners that I predicted would be a major winner back in December of 2013 has far outpaced the mining and overall market indices by a wide margin. The small junior miner is up over 200% in 2014. Find out which one and why.

Read more

Why Nickel is The Leading Base Metal in Performance in 2014

Remember the price spike in palladium (PALL) in 1999? Or the run up in uranium prices (URA) in 2007? Even more recently the move in silver (SLV) and gold (GLD) in 2011? Commodities and the mining stocks have a tendency to breakout into price spikes and frenzies. In late 2013 I told you that nickel was about to rebound.I am excited by the fantastic move this year in nickel from the low $6 range to above $9 making over a 50% move in 2014. It has pulled back for the past three months and may be on the verge of making a second leg higher.

Read more