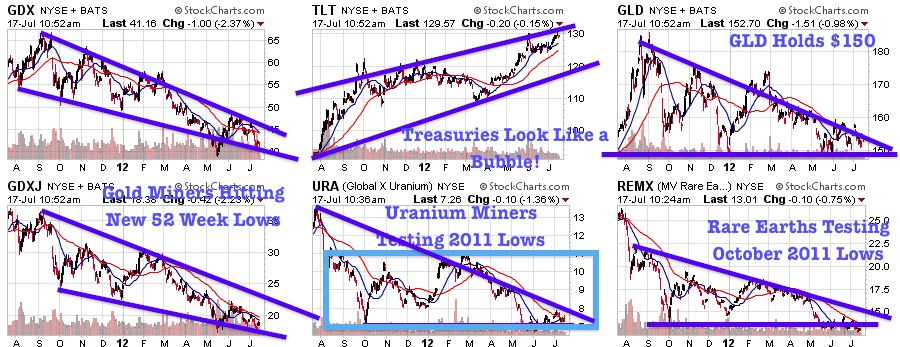

Pundits may have closed the book on the so-called nuclear renaissance, but the story is far from over. In this exclusive interview with The Energy Report, Gold Stock Trades Editor Jeb Handwerger names the "sleeping beauties" quietly proving their worth. A new generation of nuclear energy must be part of a diversified happy ending, Handwerger says, but by that time, merger and acquisition activity may have already rewarded the investors who believed in a brighter future. Read on.

Read more

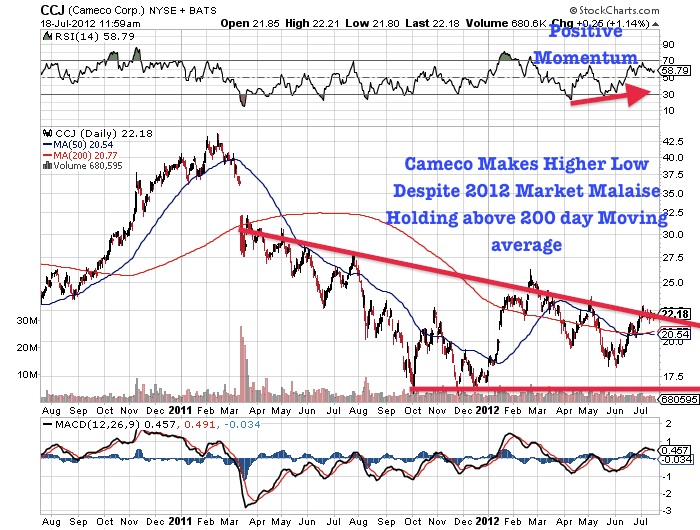

Buy Undervalued Uranium Miners Before Market Awakens To New Nuclear Reality