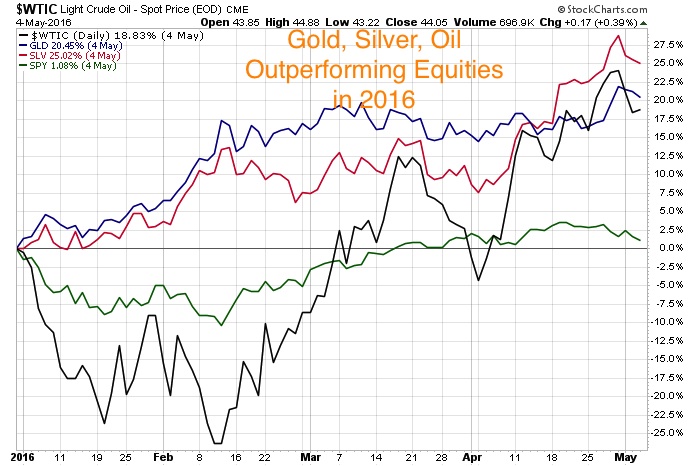

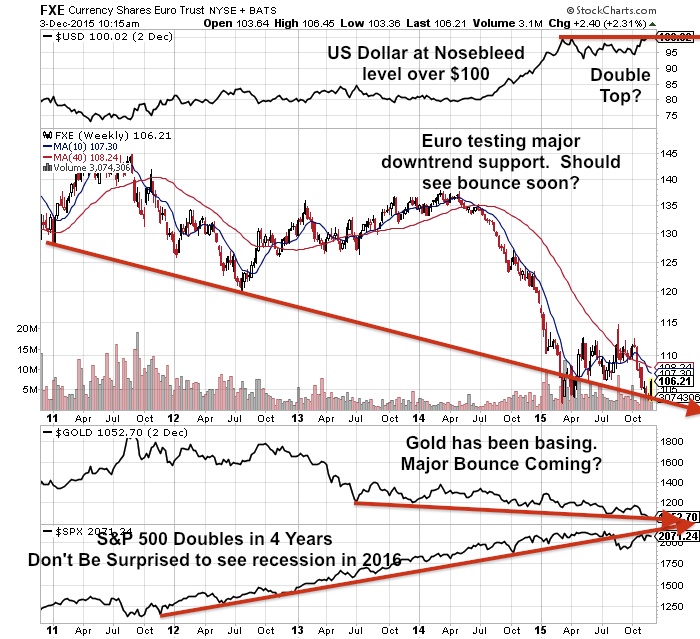

This is turning out to be one of the most powerful rebounds in gold and

silver's recent history. For a long time I have advocated patience and

fortitude with respect to wealth in the earth assets and continued to find

the top performers in the junior gold mining sector. Those that have

stuck with me are positioned now for this great run as I believe that this is the

beginning of a major new bull market. I have warned you for weeks now that new investors in juniors should wait for pullbacks to rising moving averages rather than chase.

The miners were beaten so low in this bear market that like a compressed spring bounced

so hard so fast that a healthy pullback to upward sloping 50 and 200

day moving averages like we are seeing now is quite healthy and restorative. Here are three top junior gold miners to watch.

Read more

Precious Metals Pullback To Uptrend Provides Buying Opportunities in New Bull Market