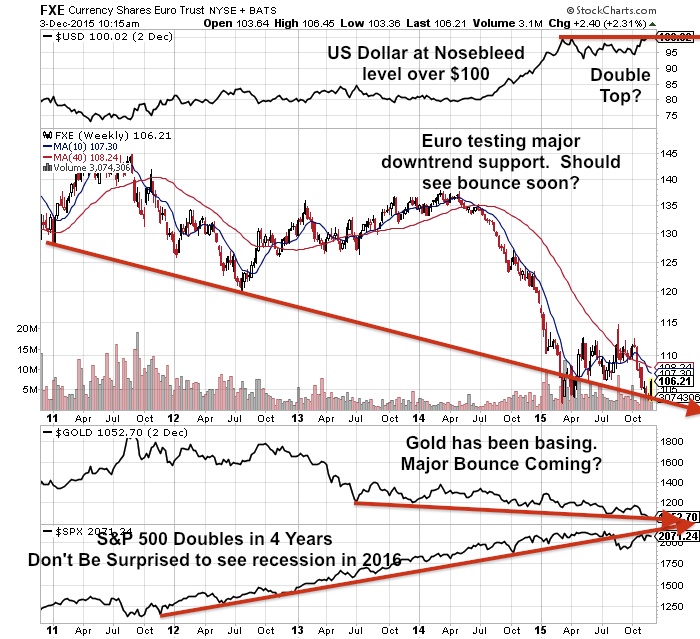

As the summer comes to an end, investors return to their offices and trading volumes tend to pick up after Labor Day. I expect that many are realizing the markets have considerably changed since May. Global equity markets are all off led by the price decline in the S&P500 which has broken its four year uptrend forming a technically bearish death cross. The name of the game right now is capital preservation and plunge protection. Look for rallies in equities to be short lived.

The Fed is expected to raise interest rates for the first time in many years on September 17th. However, there is growing uncertainty that will not occur especially due to the recent equity market volatility. Many other major economies such as China are announcing stimulus plans to prevent a recession. As the global stock markets rolls over on fear of a US Rate increase, it could boost the value in the beaten down precious metals and commodities as they may be seen as a safe haven to protect against a plunge and preserve capital.

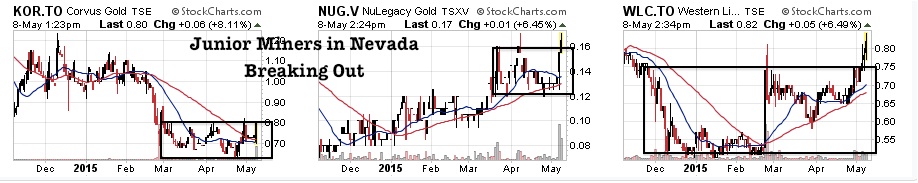

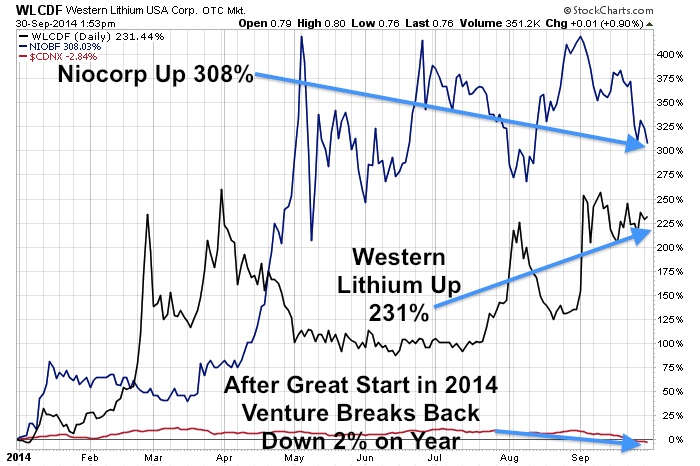

Here are ten reasons why I believe precious metals, commodities and especially junior miners may be the best place to be over the next 3-5 years. The bottoming process for the juniors after a seven year decline may be ending in the next few months as they once again come back into favor for the following ten reasons.

Read more

Once in a Lifetime Buying Opportunity in Junior Miners Might Not Last For Too Much Longer