Look at these three U.S. assets which are gaining traction breaking into new highs as they are unique and could create unbelievable value as they move closer to production.

1)In late 2011, I found an asset in Nebraska that looked even better than Iamgold's Niobec as it is higher grade. I recommended it to my subscribers and bought a position in early 2012, which I never sold. The niobium asset was phenomenal but the stock was hammered down due to the weak junior market. At the time, I was a little concerned as management did not have a track record of building mines and the financing environment was extremely challenging. I believed that the quality of the asset and commodity would eventually attract capital and first class management. Two years later the junior market appears to be emerging from a bear market the company now has possibly the top CEO/Mine builder in the strategic metals sector with the funding to advance the project. To see the interview with this legendary mine builder and mining executive click here...

2)A bill which would allow Alaska to issue bonds for this Heavy Rare Earth Deposit in Alaska. A rare earth mine in Southeast Alaska could provide thousands of job opportunities while at the same time boost U.S. domestic production and supply of the critical heavy rare earths. The bonds will help the miner finance the costs related to construction and infrastructure. For many months I told my readers not to underestimate the support of this project by the Alaskan Government. They understand that rare earths are needed in wind turbines, advanced batteries, turbines and so many consumer goods such as smart phones, tablets and flat screen TV's. China controls all these metals but has reduced the exports significantly over the past ten years with the biggest reduction in the last three years. This reduction in supply from China could be a boom to Southeast Alaska and Ucore who is ready to fill the already existing shortfall. Click here to see this exclusive interview with the COO who has built mines in Southeast Alaska.

3)This world class lithium asset is located in the mining friendly, supportive and stable jurisdiction of Nevada. It could be one of the major suppliers to battery factories such as the $5 billion plant Tesla is building. Recently, the company received a $1.5 million payment from its largest shareholder towards building a Lithium Demonstration Plant in Germany expected to be operational by the end of 2014. The company received a USA patent for its process which separates lithium and potassium from clays. The company has a prefeasibility study which forecasts lower costs against current and potential lithium producers. They recently announced that the BLM has approved the Final Environmental Assessment. This means they can operate the Hectorite clay Mine. With renewed interest in electric vehicles and lithium ion batteries, this unique junior could continue its upward breakout on record volume. Look for a breakout into new highs as renewed interest comes into this high growth sector. This year may be a major year with the Lithium demonstration plant operational by year end and the Organoclay Plant producing hectorite by the summer. Click here to see the exclusive interview with the CEO.

Premium Excerpt from 4-2-14

"A few years ago a billion dollar deal was made between CNOOC, the Chinese National Oil Corporation and Nexen, a Canadian Energy company that raised my eyebrows and which made clear the significant long term ramifications on the Western Canadian economy. The liquefied natural gas boom is picking up speed now and one of our featured companies which I highlighted several months ago may be poised to benefit and outperform the actual producers of the natural gas."

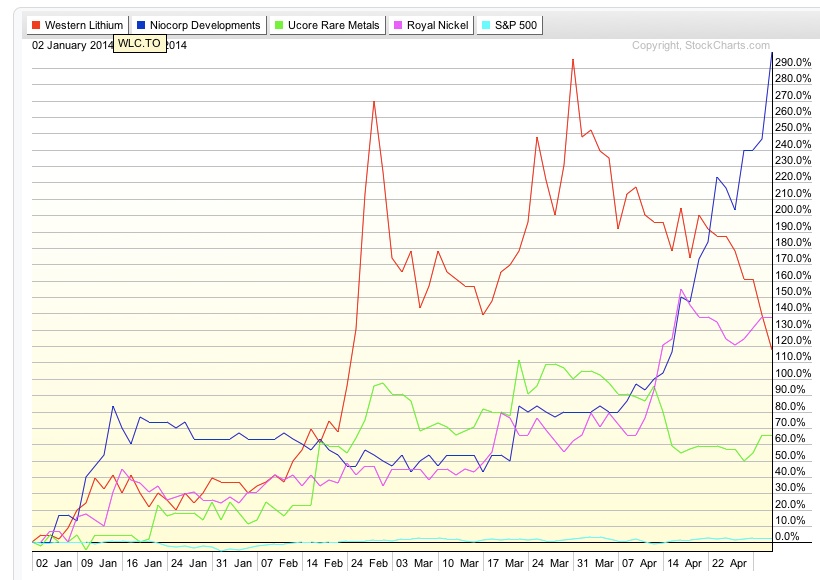

Take a look at some of our top 2014 picks and how they compare to the index.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...