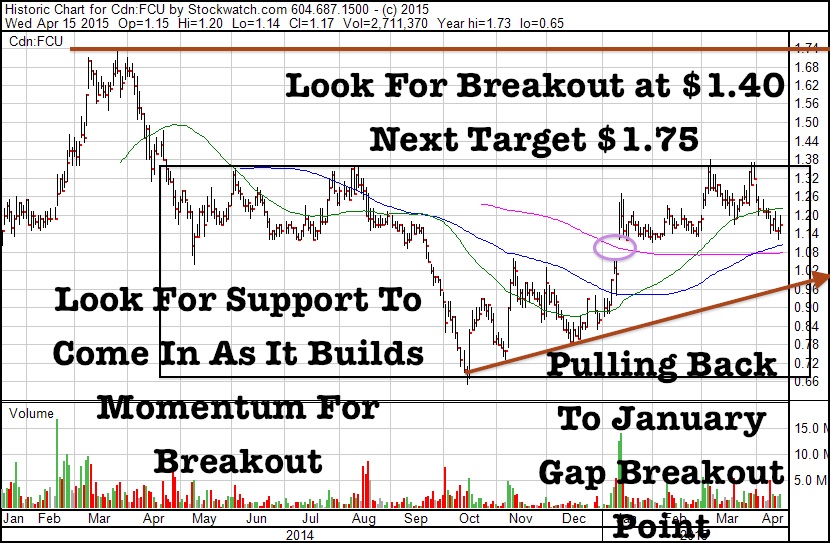

Don't buy things that are trending on Twitter or the front page of USA Today, warns Gold Stock Trades publisher Jeb Handwerger.

Buy them when they are unloved and on the back page. In this interview with The Energy Report, he singles out the unloved companies that could become media darlings in the coming boom in energy metals, uranium and—eventually—oil sectors. And he stresses the importance of the single most important commodity in the investing space ever—time.

Read more

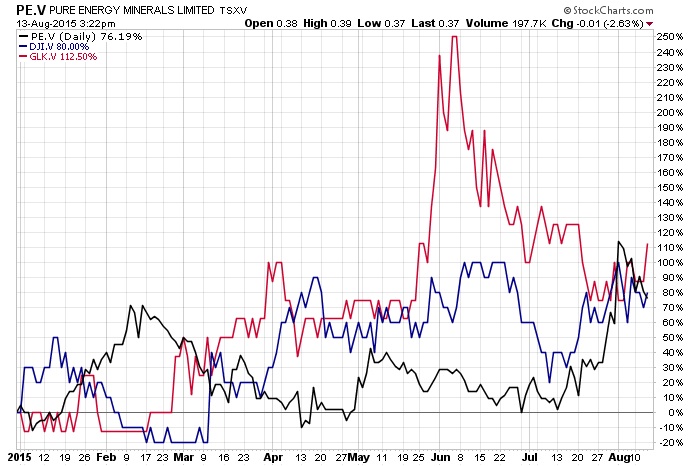

Jeb Handwerger: “Early innings of a great lithium-ion battery boom”