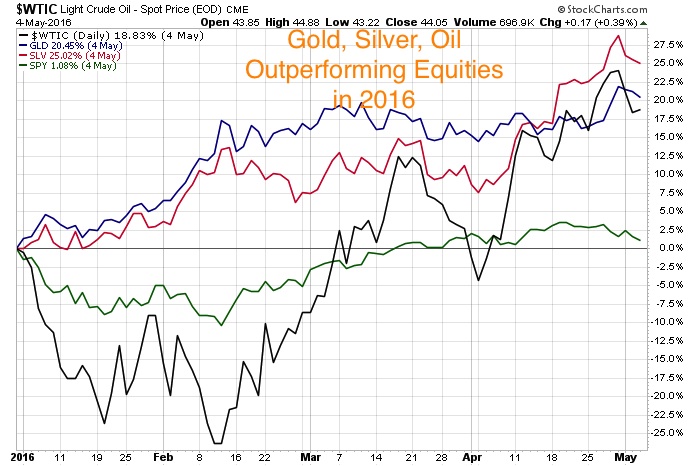

This could be a major turning point and transition from a historic bear market in the junior miners to what could be the beginning of a breathtaking move in precious metals, commodities and the junior miners. Looking at the returns year to date, silver is in first place followed by gold, platinum and oil. Smart contrarian investors have been accumulation precious metals and commodities at once in a generation price levels. The worse things got in 2015, the better they became in 2016.

Read more

Could This Be the Start of an Early Bull Market in Precious Metals and Commodities?