Gold and silver mining stocks are going through a pullback after jumping considerably in the first quarter of 2014. Despite the correction in gold mining equities, I have searched for undervalued gold situations with large deposits and the financing to advance the project. Eventually, the junior gold and silver stocks will rebound magnificently from these historic oversold levels. Value investing contrarians look at this junior gold miner trading at less than one third of its book value.

Read more

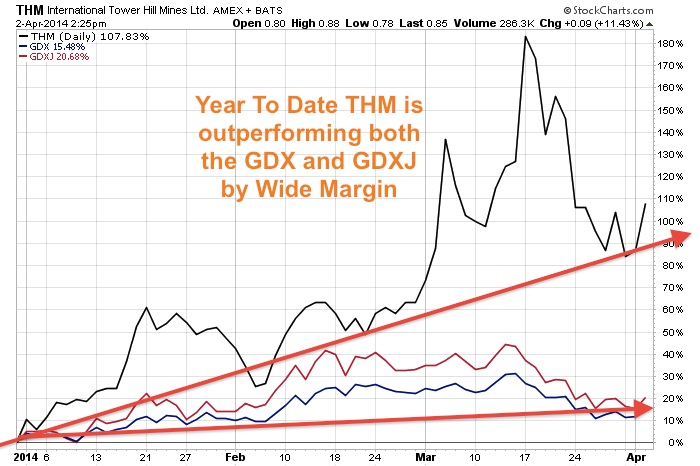

This Junior Gold Miner is Trading at Less Than One Third of its Book Value