The lithium market which has been in consolidation after a major upward move earlier this year may be ready to start its next move. News being reported by Reuters states that a big Chinese battery maker is in advanced stages of negotiations to buy a piece of Sociedad Quimica y Minera (SQM) one of the world's largest lithium producers. Could the Chinese be looking at junior lithium explorers as well?

This move by the Chinese reaffirms our long term commitment to the lithium battery sector which I was in way years before it started catching on. We may be ready to witness the next move higher which could even be greater that what we saw in the past.

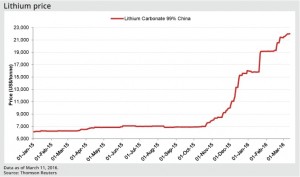

Lithium prices are continuing to skyrocket especially with news coming out of Tesla that they are reaching major technological breakthroughs with their electric vehicles. This is a sign that the Chinese are catching on to the lithium boom and it may auger even better times ahead for the junior lithium developers and explorers.

Lithium prices are continuing to skyrocket especially with news coming out of Tesla that they are reaching major technological breakthroughs with their electric vehicles. This is a sign that the Chinese are catching on to the lithium boom and it may auger even better times ahead for the junior lithium developers and explorers.

Despite the recent rise of the lithium sector over the past year, the rising demand of electric vehicles could make lithium mining quite profitable over the next decade. The value could be in the companies making new lithium discoveries.

Yes Lithium is in a bubble now that I predicted years ago but we may be setting for the next stages of this parabolic bubble which are making astute investors a fortune. We could have one more big climax run that could make the prior moves look like nothing. In fact, many of the stocks have corrected since April and may be providing an additional buying opportunity and I believe we could be setting up for a climax run going into 2017. Remember Lithium (LIT) stocks have led the market now for 2014 and 2015. It won't be a shocker if it happens again in 2016. Don't forget some high quality graphite stocks to include as well as graphite is a critical component of the high performance batteries.

Yes Lithium is in a bubble now that I predicted years ago but we may be setting for the next stages of this parabolic bubble which are making astute investors a fortune. We could have one more big climax run that could make the prior moves look like nothing. In fact, many of the stocks have corrected since April and may be providing an additional buying opportunity and I believe we could be setting up for a climax run going into 2017. Remember Lithium (LIT) stocks have led the market now for 2014 and 2015. It won't be a shocker if it happens again in 2016. Don't forget some high quality graphite stocks to include as well as graphite is a critical component of the high performance batteries.

Here is a sneak peek to a few positions which I own and are current website sponsors.

1)Junior graphite company on verge of publishing Preliminary Economic Assessment in 3rd Qtr raises $1.3 million in oversubscribed offering. They own the largest large flake graphite deposit in the United States.

2)This Lithium battery technology company received a $2 million commercialization grant. They received the first of four installments which will allow the construction of a pilot plant that could be completed in early 2017. I wouldn't be surprised if some Chinese battery entities get interested in this technology over the next few months.

3)This junior lithium prospect generator announced that they paid all the annual BLM fees for all seven of their lithium properties in Nevada. The prospect generator model allows the company to diversify the risk by Joint Venturing with other junior explorers. This allows them to make some money through cash and marketable securities hopefully minimizing dilution.

4)Keep a close eye on this junior trading for pennies which may be acquiring an exciting lithium property in Nevada. The area has a ton of interest as another comparable company owns a neighboring land position but sports a market cap almost ten times larger.

5)Don't forget their are some great lithium deposits that coexist as a byproduct with uranium. Lithium prices are soaring into new highs while uranium prices are depressed at multiyear lows. However, both are critical for carbon free energy and oil independence. There are two juniors in Peru advancing these uranium lithium deposits. They may come back into favor when uranium rebounds and follows lithium and graphite as the critical clean energy metals.

Disclosure: I own securities in these five stocks that I linked to. They are also website sponsors. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link:

http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/

Investing in stocks is risky and could result in losing money. Buyer Beware!

Section 17(b) provides that: “It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.”

I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. I own shares in all sponsored companies. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence!

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.