There is no doubt about it. Junior gold mining companies are going through a time of testing. Gold and silver prices are basing at multi-year lows.

Financing markets are tough for junior precious metal miners. Many of these companies will not succeed in these difficult times without a strong treasury and shareholder support to weather the storm.

These corrections separate the quality junior miners from the weak ones as the smart management teams pick up quality assets for pennies on the dollar and actually build value during these cyclical corrections. This is the evolutionary way of the markets to weed out the weak entities.

Junior mining investors especially during these trying times must constantly reevaluate and make sure their junior mining investment has the ability not only to survive this market, but to possibly thrive in this environment by picking up quality assets on the cheap. Instead of exploration capital being put into the ground, there may be opportunities in undervalued assets, if you are connected to the right technical team.

Look at Miranda Gold (MRDDF or MAD.V) who has one of the top exploration teams in the business. The dream team has been involved with over 10 Nevada discoveries totaling more than 60 million ounces of gold.

The company is cashed up with over $8 million in the treasury. Miranda recently financed back in December of 2012, $5 million in tough markets. While others juniors are desperately seeking capital, Miranda’s financing was oversubscribed by 67%!

This capital came from some of the smartest minds in the business including Sprott Global, Adrian Day and Raymond James. What are they liking that the market is missing as Miranda hits decade lows and is now cheaper than the prices the pro’s paid? Miranda is cashed up in the right place in Nevada and Colombia, with the right management team.

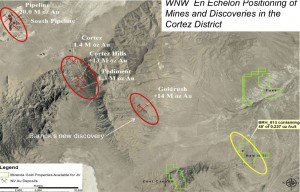

In Nevada, they are in the highly profitable Cortez and Carlin Trend, which is rewarding the majors like Barrick and Newmont with low cash cost production. The majors are looking to cut costs abroad and focus on Nevada, especially the Cortez Trend where Miranda has already made a significant discovery at their Red Hill Project.

This area south and southeast of Barrick’s Goldrush which is growing to over 14 million ounces of gold must be followed as there is an established trend of monster mines that produce gold very affordably.

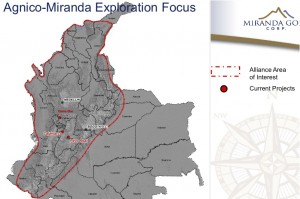

In addition, Colombia is exciting for Miranda’s seasoned exploration geologists as it is one of the least explored South American countries, but has some massive discoveries. Over 96 million ounces of gold have been found in Colombia over the past 10 years. Miranda has an agreement with one of the best majors Agnico Eagle Mines that will help fund Miranda generate projects for the alliance. What is fascinating about the deal is that it is in essence a $2.3 million dollar non-dilutive financing.

In conclusion, the recent deal with Agnico Eagle and oversubscribed financing puts Miranda Gold’s skilled management team in place to build value for shareholders by hopefully making a discovery. Remember Miranda Gold is a prospect generator which generates leverage by partnering with other explorers.

Approximately $2.75 million of “Other People’s Money” will be spent this year on several projects. Mira Miranda and their experienced management team which has the support of the smart money. One drill hole could make all the difference.

Miranda should find support at decade lows and this pullback provides junior mining investors an opportunity to possibly rotate into a situation where you can buy shares cheaper than the professional investor. Remember Miranda ran to over $2 in 2006 and has survived the 2008 downturn.

Listen to my recent interview with Miranda Gold’s CEO Ken Cunningham by clicking here...

Ken is one of the best geologists in the business and he highlights why Miranda Gold is in a position of strength to capitalize from this downturn in the juniors.

Disclosure: Author is long Miranda and Miranda is a sponsor of Gold Stock Trades.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see further interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...