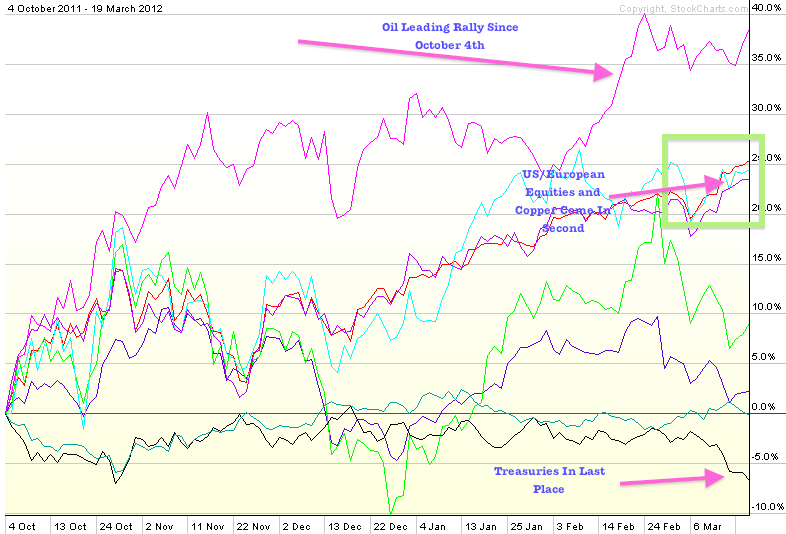

Treasuries are rallying on fears of a slowing economy in the U.S. after weak economic data was released recently and as geopolitical uncertainty increases in the Eurozone. France has an election May 6th, where we may see a possible changing of the regime. Sarkozy has been one of the central players in this debt crisis.

European leaders have been unable to manage debt loads. Austerity measures are failing. The U.S. is in an election year as well. It seems doubtful that European governments and Central Bankers will allow conditions to worsen without stimulative interventions.

We may see further moves before the U.S. election which could keep interest rates low and at the same time stimulate growth. The tool at their disposal is extension of Operation Twist or a new QE or a new LTRO by June should the economy weaken or should unemployment rise.

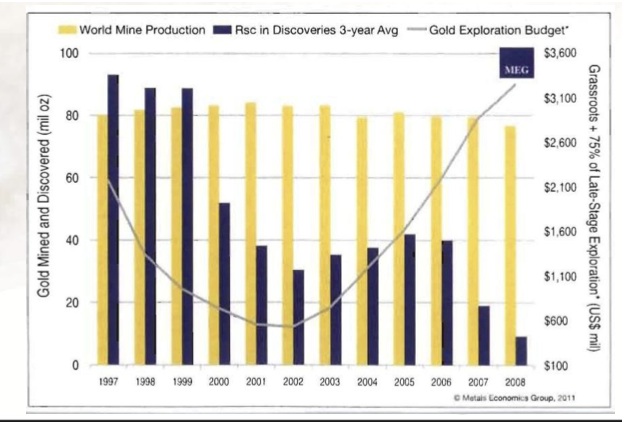

Spain is experiencing their second recession since 2009. We are seeing failed austerity measures. GDP decreasing and debt loads increasing will force the ECB to form another round of LTRO to refinance troubled banks. Spain may also consider fast tracking some precious metal assets to provide jobs and revenue to the country. Spain has around a 25% unemployment rate. We have been looking at precious metals and commodity assets specifically in Spain as we are observing a positive change for mining to boost jobs and the economy.

There is a strong interconnection between US banks and European Banks ergo we have a rising fear of debt contagion which could put pressure on the U.S. Economy. Bernanke is well aware of this and changed his tune at the last meeting where he stated that Central Bankers stand ready to add stimulus should the economy demand it. This was definitely a hint at QE3 where the Fed prints dollars to buy bonds keeping interest rates artificially low so the government can pay down its rising debts, stimulate growth, and devalue the currency to punish savers.

Read more

Will Biggest Reduction In Interest Rates In Three Years Increase Gold and Silver Demand?