Remember the price spike in palladium (PALL) in 1999? Or the run up in uranium prices (URA) in 2007? Even more recently the move in silver (SLV) and gold (GLD) in 2011? Commodities and the mining stocks have a tendency to breakout into price spikes and frenzies. In late 2013 I told you that nickel was about to rebound.

I am excited by the fantastic move this year in nickel from the low $6 range to above $9 making over a 50% move in 2014. It has pulled back for the past three months and may be on the verge of making a second leg higher. See my recent interview with CBS Marketwatch by clicking here...

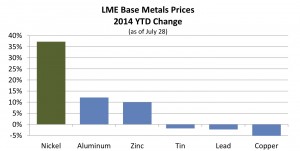

Why is nickel breaking out in 2014 outperforming other commodities and equities?

Nickel prices are hitting multi-year highs for three major reasons.

1)Indonesian Export Ban

2)Russian Economic Sanctions

3)Disruption to existing production at major mines like Vale's Goro Project.

Demand for nickel is increasing every year despite lower overall economic growth. Nickel is used to make stainless steel. As populations expand and urbanize more stainless steel is required to build bridges, pipelines, skyscrapers and power plants.

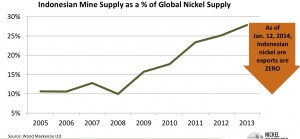

Indonesia supplies over a quarter of worldwide nickel. Over four months ago I wrote to my readers, "The announcement that Indonesia has banned exports could have a dramatic effect on supply and cause a reversal in the nickel price which is still more than fifty percent below its all time highs."

To put this move from Indonesia to ban exports into perspective think of all the OPEC Gulf states ceasing oil production or Chile cutting copper exports. China may be growing nervous. Close to 75% of China's nickel pig iron supply comes from Indonesia.

Other countries such as Japan, Australia, Canada and the U.S. could be significantly impacted by this rise in resource nationalism in Indonesia and Russian economic sanctions. Do not forget Russia is a major palladium and nickel producer. The nickel price is making a breathtaking move higher. There are very few sources of high grade nickel outside of Indonesia, The Philippines is another option but they are also considering an export ban.

Even though there is still a large amount of nickel in stockpile, experts are predicting that inventories could run out by mid 2015. Enter center stage junior miners who control nickel projects particularly in mining friendly North America. I am focusing on companies that could come into production to fill the shortfall in the next 2-3 years.

The rise of resource nationalism in Indonesia is nothing new. Nations may have already been planning for the export ban this month by stockpiling. Nevertheless, smart investors should position themselves in top quality junior mining nickel assets or look at the Nickel ETF (JJN).

There are very few high quality nickel projects ready to be built.

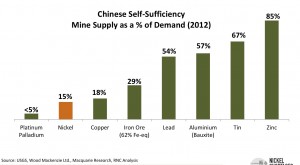

Before the previous run up in 2006-07 there were plenty of undeveloped projects. This is not the case today. Nickel is one of the few commodities that China needs desperately as they have very little from their own production.

Royal Nickel Corp.'s Dumont Nickel project in mining-friendly Quebec [could] begin construction by the end of this year and start production in 2016. . .[the] Dumont project is one of the largest nickel deposits in the world and probably the largest, most advanced and best quality nickel projects in the control of a junior miner. . .the company is significantly undervalued and my readers have already seen close to a triple since originally highlighted.

Royal Nickel owns one of the only mines I know of with a construction-ready project, experienced management that specializes in nickel and a strong treasury of close to $15M. Royal Nickel's Dumont Nickel project is one of the best advanced nickel projects under the control of a junior. It could begin construction by the end of this year and start production in 2016.

The company has a management team that knows nickel possibly better than any other junior, as it has some of the top Falconbridge Ltd. and Inco Ltd. personnel and management on the board of directors. Dumont is one of the largest nickel deposits in the world. I expect the nickel price to start heading higher as the 8 week pullback may be ending. Much more interest may come into the nickel sector. There are very few assets like the Dumont project in the control of a junior like Royal Nickel (RNX.TO or RNKLF).

Check out my recent interview with Mark Selby, CEO of Royal Nickel (RNX.TO or RNKLF) by clicking here or on the link below. Mark has over 20 years of experience in the nickel sector with such mining giants as Quadra and Inco.

For more information on Royal Nickel please contact:

Rob Buchanan Director, Investor Relations T: (416) 363-0649 www.royalnickel.com

Disclosure: Author owns shares and the company is a website sponsor.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend.

To send feedback or to contact me click here...