Similar to Peyton Manning and Joe Montana, uranium is making a great fourth quarter comeback after many fans have already left the stadium.

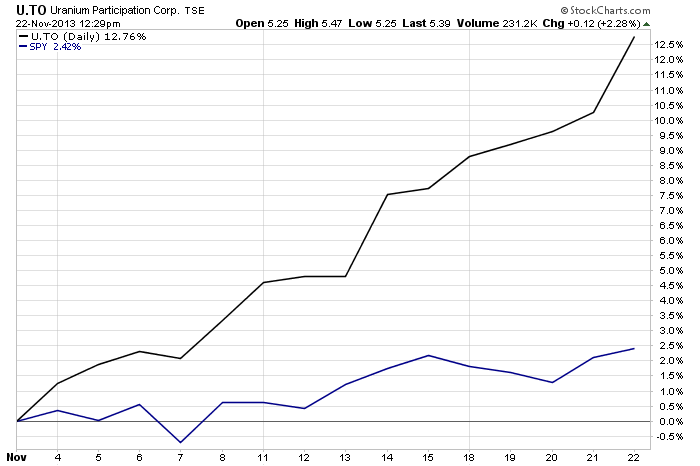

I highlighted in this article at the end of October that the high volume coming into the uranium miners may have forecasted a turning point. Since that time the uranium spot price has had consecutive weeks of positive price performance and may beginning to make a major move. I urge you to pay attention to the uranium spot price as evidenced by Uranium Participation Corp (URPTF) as it begins to creep above the 200 day moving average. Uranium Participation is outperforming the S&P500 in November up over 13% while the S&P500 makes a 2.5% move.

The uranium miners should begin outperforming to the upside as well. In addition to the article, I recently discussed in an audio interview with Palisade Capital at least seven reasons why the uranium sector could soar mirroring the 2007 melt up where uranium hit $135/lb. In addition, I wrote an article, "Will The Uranium Price Make a Fourth Quarter Comeback?" in early October outlining at least seven reasons why the uranium price should see positive price momentum.

1)The toxic air pollution in China and India is killing people and it's driving demand for clean nuclear energy and rare earths.

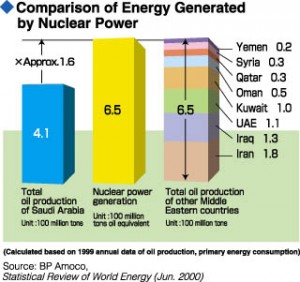

2) Oil rich countries like United Arab Emirates and Saudi Arabia are making a huge statement investing in nuclear to reduce their dependence on fossil fuels.

3)Countries have recently lifted bans on uranium mining and building reactors after decades of moratoriums.

4)Cameco (Bellwether large uranium miner) shocked markets recently by posting a profit, even with uranium at 8 year lows. Imagine how Cameco could perform with uranium at higher prices.

5)M&A in the uranium sector has been exceptional over the past two years. Fission, Denison, Energy Fuels, Uranium One...

6)The ending of the Russian HEU megatons to megawatts program. This provided the U.S. with cheap uranium from Russian nuclear warheads for 20 years.

7)There are more nuclear power plants under construction now, than there were before Fukushima. The world is realizing that we need nuclear power for clean energy.

In conclusion, watch these three junior uranium mining stocks as we end 2013. We may be watching a great fourth quarter comeback in some of these high quality junior mining shares.

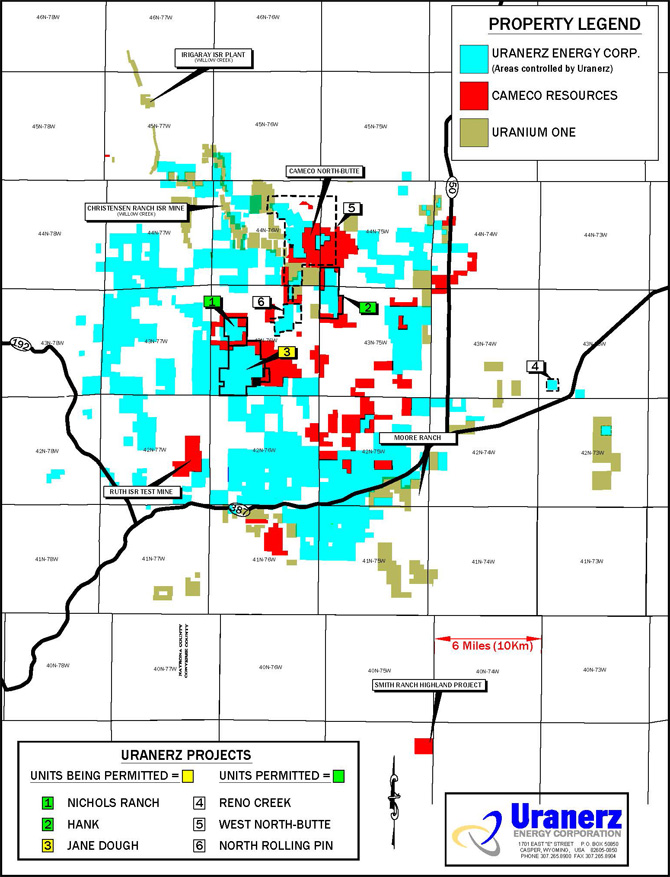

1)The ending of the Russian HEU Megatons to Megawatts program will require new U.S. uranium mines to cover the 24 million pound shortfall. This junior uranium miner is constructing a mine in the Powder River Basin in Wyoming. They control a huge and strategic land position around Cameco and Uranium One. The management team has decades of experience in licensing, constructing, financing and operating uranium mines. Unlike so many other juniors they should start seeing revenue and sales as they have contracts with some of the largest U.S. nuclear utilities at higher prices.

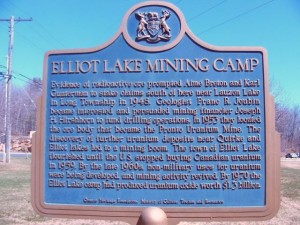

2)More than 300 million pounds of uranium were mined in this district by Rio Algom and Denison Mines. It was once known as the Uranium Capital of the World and was the only area that commercially produced heavy Rare Earth Oxides in North America. These mines were closed down in the 90's when critical rare earths were unknown and uranium was trading below $20 a pound. Could a rebound in uranium and rare earth prices revive this historic uranium and rare earth district?

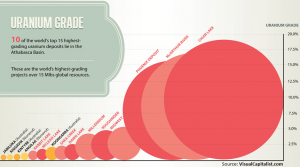

3)The Athabasca Basin is attracting major capital as it is one of the only areas in the resource space where junior explorers are raising capital after recent richly priced takeovers. These speculative funds are looking for 10-20 fold increases. The key to invest in early stage exploration is to find the right people and geologists. Look for the best explorers who have proven track records of success in the Athabasca Basin. See this exclusive interview with this famous geologist who was instrumental in the discovery of Fission's J-Zone Discovery which was bought by Denison and the Patterson Lake Properties where Fission and Alpha have made a massive discovery.

I will be moderating a panel on Tuesday November 26th from 11:49-12:33PM at the San Francisco Metals and Minerals Conference with the smartest analysts in the business Jay Taylor, Mickey Fulp and John Kaiser. The topic will be exploration trends. To find out about attending the San Francisco Metals and Minerals Conference on November 25th and 26th click here. Hope to see you there!

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...