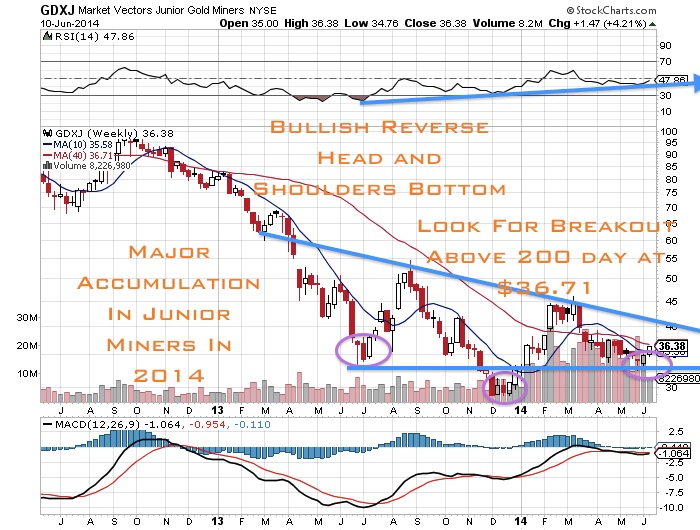

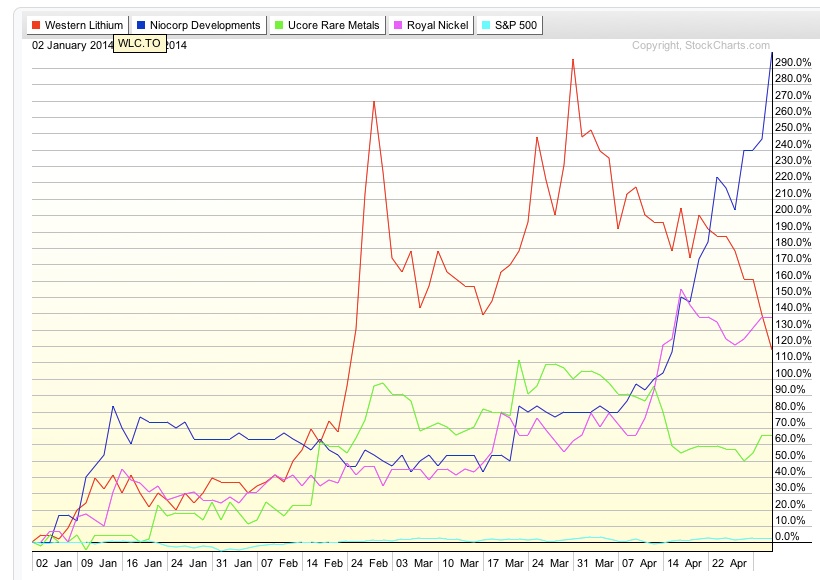

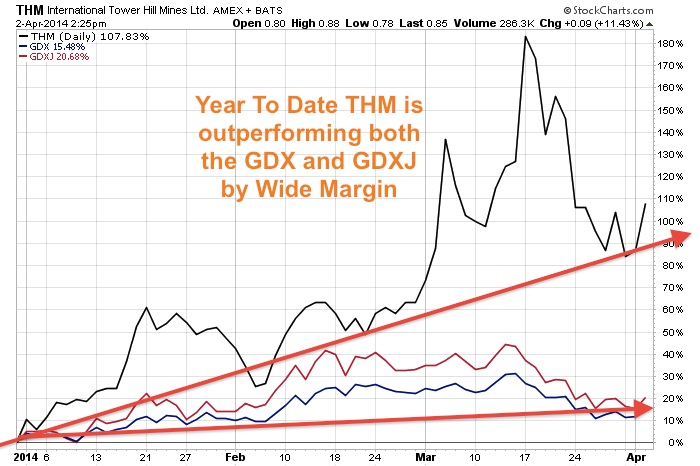

The gold (GLD) and silver (SLV) price may be reversing over the next couple of weeks. The junior miner gold ETF (GDXJ) is reversing above the 50 day moving average and breaking above its recent three month downtrend. When the huge cash positions waiting on the sidelines or taking profits in the equity market rising on low volume return to the ignored resource sector the gains could be huge. Already the volume in GDXJ in 2014, has jumped outpacing 2012 and 2013. On the other hand the S&P500 has been rising on light volume which is often a warning sign that the extended rally is getting exhausted. This indicates to me that possibly the large institutions are accumulating the juniors after all the retail investors jumped ship. Prices could jump rapidly in the Toronto Venture Exchange where most of the legit junior miners are traded. These small cap juniors could gap higher as the major institutions are hardly exposed to the mining sector at all. It appears that some of my charts are showing a potential reversal in the precious metals. Get ready for an incredible bounce higher in precious metals. Here are five reasons why.

Read more

Why Capital May Be Flowing From Equities to Junior Miners in 2014