The recent news that electric car maker Tesla (TSLA) is planning to construct the biggest lithium-ion battery plant right here in the USA may be validating our long term buy and hold investment thesis in this once ignored sector. Tesla has announced that they are planning to produce an affordable electric car for the US market within three years. This is a huge catalyst for the North American lithium and graphite miners who will be able to supply companies like Tesla. Battery manufacturing could be a major area of economic growth over the coming decades. Similar to the internal combustion engine, lithium-ion batteries could revolutionize transportation over the coming decades and reduce the world's carbon emissions. Tesla has a market cap of $31 billion and may now be on the lookout for some of our lithium and graphite juniors in North America that we have been writing about for many years that are still trading for pennies on the dollar but are on the verge of major breakouts.

Read more

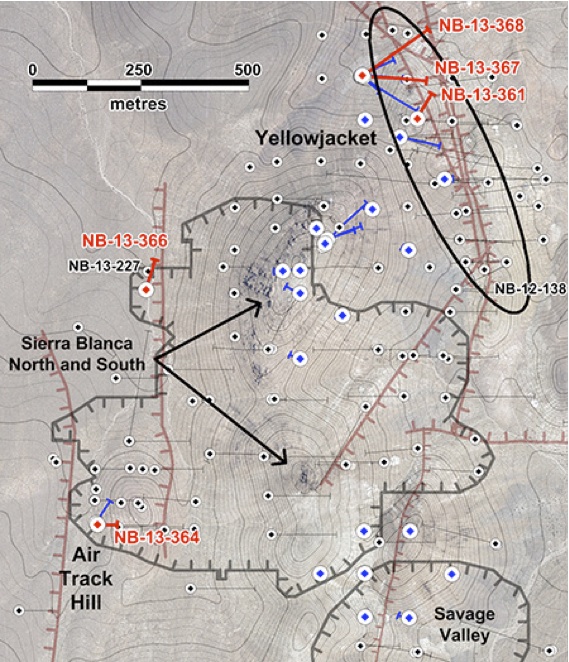

Battery Market Is Powering Up Demand For This Lithium Asset In Nevada