Gold and silver are on the verge of a major move higher as the dollar is showing signs that it could crash into new lows.

Even though the U.S. Government averted default, the potential uncertainty and deleterious ramifications on the economy could force the Fed to increase Quantitative Easing.

Look for volume to reenter the gold, silver and junior mining market as investors look to get out of their dollars into traditional inflationary hedges. Investors may soon realize that Congress may avoid a debt default for now, but it is only a temporary solution as the economic problems are nowhere near solved.

Be prepared for a "V" shape reversal in gold, silver and the junior miners which have been basing for close to three years and are very oversold. Investors may be a little early in claiming good times are here again. The global economy and debt situation remains challenging. Gold and silver appear to have found support and may be on the verge of a major reversal higher. Look for a reversal above $1300 to break the recent seven week consolidation.

I like silver even more than gold as demand is increasing for this white metal as an alternative to fiat currency and for its rising industrial applications. A breakout could occur past $22. Silver is in a three month uptrend which has stayed intact.

A correction in the overbought equities especially biotech, housing and banks could cause precious metals to regain its luster. We have been seeing an outflow from the gold and silver ETF's as investors may be looking to the miners which are historically discounted compared to the bullion price. The miners may be making a double bottom here. Gold and silver may successfully bounce off the June lows.

I expected this last minute agreement which will kick the debt can down the road. People may begin to think, do our representatives really know what they are doing? Is this all just a show? Are they playing with the masses minds?

For many months, we have heard that the Fed may taper quantitative easing through many mainstream media outlets. Now the time has come when the masses may have already priced in a reduction of quantitative easing, not realizing that quantitative easing may actually increase and is ongoing.

The Fed may have used the taper terminology as a tactic to keep inflation and precious metals subdued. I believe there are growing concerns of a reinflated housing and financial bubble on the verge of a double dip.

The equity markets have moved way ahead of the economy where we see a record numbers of Americans who are exiting the labor force and are becoming unfunded liabilities. The U.S. debt crisis is not over.

Look at Detroit and many other cities in or on the verge of bankruptcies due to unfunded liabilities. All across the U.S. deficits are rampant. Debts are strangling cities and municipalities. How soon investors forget that only a few months ago Detroit, the industrial and auto manufacturing center of the U.S., became the largest municipality in U.S. history to file for bankruptcy with unpaid debts of over $18 billion.

The Fed needs to protect these cities on the verge of bankruptcy by manipulating interest rates lower. This is done through quantitative easing. Talks of taper over the past few months have crushed U.S. bonds with yields doubling over the past year.

I called the top in treasuries back in July of 2012 as I realized the Chinese, Russians and many other emerging nations holding U.S. debt want to sell and avoid a decline in the United States. The Fed does not want this and will try its utmost to prevent a rise in interest rates as more cities and states could possibly file bankruptcy. More municipalities going under could put a lot of pressure on unemployment.

Over the past fifty years the U.S. has sent its industries offshore resulting in a massive transfer of workers from manufacturing into government. The jobs number was awful with the unemployment rate going down for the wrong reason. More employees are leaving the work force.

Rising interest rates could initiate the next decline in housing. The Fed must be very careful as they fear rising rates could spark more bankruptcies, higher unemployment and pop the reinflated housing bubble.

Look for gold and silver to bounce higher, which have been correcting since the July-August rally due to fears of tapering. However, I expect a bounce to occur.

There are just too many black swans, the Middle East crisis with Syria and Iran is not over and the risk of rising inflation globally is greater than ever as countries deal with debts gone wild. Look for a rally in high quality junior miners advancing top notch gold and silver assets in friendly mining jurisdictions.

What we may be witnessing now is just the beginning of a major rally in gold as local, state and now the federal government deals with bad debts brought on by years of reckless spending. Acts of terrorism and violence are becoming more commonplace around the world. Gold and silver has proven itself throughout the history of mankind to be one of the only assets that is stable in a shaky world.

Gold may have bottomed at the end of June after going below $1200 as shorts began to cover their positions and as tensions with Syria heated up. Recent weak economic data combined with debt woes should continue to support an accomodative Fed.

This recent shutdown should push off any taper indefinitely as unemployment numbers are not improving. Equity markets could correct from these overbought levels and gold and silver could outperform towards the end of this year.

Watch silver which is forming a bullish cup and handle pattern. A breakout could be imminent. Look for a Bullish MACD crossover and a break above the 6 week downtrend. The three month uptrend should hold here. We can observe that the June and August gap has been closed. This could be an area of support.

Remember a credit downgrade and/or further weakness in the U.S. dollar and bonds could lead to a precious metals frenzy. Gold and silver have now been basing for over two years since the last debt debacle in Washington when gold hit $1900 an ounce.

Don't be surprised to see economic uncertainty cause a parabolic rise in both gold and silver possibly into new highs in early 2014.

This decline over the past three years was prompted by the end of QE2 when the media programmed the public that The Fed will end quantitative easing and dollar devaluation. Just the opposite occurred. QE to infinity was announced and still The Fed and the media try to jawbone the public to believe that they will exit quantitative easing.

The Fed has made it appear the markets have recovered but I am still very skeptical. Between the gridlock over Syria and Obamacare, investors may be growing weary of their faith in the U.S. dollar and bonds. This is a divided country.

Astute investors may begin moving to precious metals and mining equities which are reaching historic oversold levels. For over a month I have alerted my readers to prepare for a rally in precious metals following the Mid-October deadline over the debt ceiling which could put gold and silver back into the limelight as Central Bankers prepare more QE.

Gold and silver have been manipulated lower by fear-mongers who claims that the gold bubble has burst and that the Fed will tighten. I continue to disagree with this view. The long term trend in precious metals remains higher and tapering should not occur as the U.S. deals with gridlock and needs to pay off soaring debts and the costs of Obamacare with cheap dollars. It may be time to continue buying the highest quality junior miners trading at historical lows.

Only the best mining stocks who are active in stable jurisdictions will survive as this has been the worst decline in mining equity history. The top ones will thrive and actually benefit from this environment.

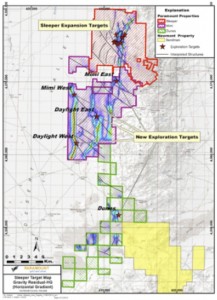

One of our featured stocks that I am a shareholder and that I am proud to have on as a sponsor is already listed on the NYSE and in the prestigious Russell 2000 index. Paramount just hit a major discovery at its San Miguel Deposit adjacent to Coeur's Palmarejo world class producing gold and silver mine. Paramount Gold and Silver (PZG) recently announced that a major new structure has been found which traces for more than 4 km.

The company put in two preliminary drill holes which showed impressive results intersecting several veins. The best intercept averaged 0.61g/T of gold and 31.6 g/T of silver of 11 meters. This new structure runs onto the ground of Fresnillo, the world's largest silver producer. In addition to Fresnillo, Paramount's property surrounds Coeur D'alene's Palmarejo Mine.

Christopher Crupi, Paramount’s CEO, commented in the Press Release: “… San Miguel remains an outstanding exploration project as well as a robust mining opportunity at even lower than current metal prices.”

Paramount Gold and Silver (PZG) has been very busy this summer exploring its world class San Miguel Project which completely encompasses one of the top operating silver mines in the world operated by Coeur D'Alene. I intend to visit the project in the near future.

Paramount's San Miguel Property is located in The Sierra Madre Gold-Silver Belt. This area of the world is attracting major interest from the big boy miners such as Pan American Silver (PAAS), Goldcorp (GG), Agnico Eagle Mines (AEM), Alamos Gold (AGI), Argonaut Gold (ARNGF) and the world's richest man Carlos Slim's Minera Frisco who recently acquired the 4.6 million ounce Ocampo Mine.

Paramount's high grade 3.3 million ounces are extremely desired by the major players especially their next door neighbor Coeur D'alene. When this market turns I believe Paramount could be one of the best takeover targets for a major looking to expand in one of the best and low cost areas to mine in the world.

Paramount's San Miguel already has a published Preliminary Economic Assessment which showed an asset highly competitive and arguably more economic than some of the other miners that were acquired or are currently producing in the Sierra Madre Belt. The PEA at San Miguel showed an impressive average gold equivalent grade of 3.18 g/t and positive metallurgical recoveries of over 90% for the gold open pit and 80% for the silver open pit. Even in a lower gold case scenario the mine would be economic with a 24.5% IRR at $1300 gold and $25 silver. Cash costs are around $513 at that level.

In addition, there is a lot of potential to improve these numbers in the near term. Paramount has not yet updated the numbers with the more than 50 drill holes from the high grade Don Ese Vein. Several zones are being expanded and the new resource update will take into account these high grade intercepts, which should garner the attention of the smart major miners or billionaires like Carlos Slim.

In addition to San Miguel, Paramount controls the famous Sleeper Gold-Silver Mine three hours from Reno, NV near Winnemucca. I had the pleasure to visit the property a couple of weeks ago with some other strategic investors.

The Sleeper Project impressed me with its infrastructure as it has gravel roads, a flat terrain and power lines running through the property. The market is not valuing Paramount's Sleeper Project at all, however they soon may be aroused from their slumber. The best time to buy a mine is when the market is asleep.

Paramount controls approximately 30 square miles surrounding the historic Sleeper Pit which began production in 1986 and ended in 1996. Sleeper produced 2.3 million ounces of silver and 1.6 million ounces of gold.

Currently, Paramount has defined a massive NI 43-101 inferred resource of over 5 million ounces of gold and 61 million ounces of silver. The basic infrastructure is there such as a gravel road and connection to the electrical power grid and all weather highways. Sleeper is near the city of Winnemucca which has an available labor pool of experienced mine operators.

The Sleeper Mine has a great history. When it first opened it produced gold at less than $60 per ounce making it one of lowest cost mines in the world at that time. Armed guards had to stand in the pit to guard against theft as there was high grade visible gold nuggets. In the picture I am standing on top of the Sleeper Pit which was mined for a decade.

I met Nancy Wolverson at the project. She is the head geologist on the Sleeper Project for Paramount and has over 30 years of worldwide exploration experience. Nancy believes that these veins do not occur in isolation and more of these high-grade bonanza zones could occur on the property. Nancy is enthusiastic about the new South Sleeper Zone and the West Wood discovery.

In addition to the exploration potential, in September of 2012 the company published a Preliminary Economic Assessment on Sleeper, which showed incredible leverage to rising gold and silver prices. Sleeper is probably one of the largest undeveloped gold-silver assets in Nevada and the United States. At the base case of $1384 gold and $26.33 silver the current deposit prior to all the recent drilling showed an IRR of 26.8%. Should gold move higher to $1900 the Net Present Value jumps exponentially from $1.2 billon to $2.7 billion. These are large numbers considering the market is not valuing it at all.

Paramount has a strong treasury with close to $12 million in cash and a low burn rate. Insiders have a large stake with control of close to 16% of the float. Paramount CEO Chris Crupi has bought over $400,000 in the market over the past two years and recently bought 20,000 shares at $1.28 according to insider filings. Chris now has over 4 million shares. This is a vote of confidence by the CEO as he puts his money where his mouth is and believes a turn higher is coming sooner rather than later for PZG.

Paramount trades a lot of volume and has great liquidity. Close to 22% is controlled by institutions led by Albert Friedberg's FCMI who controls close to 17 million shares. Paramount is in the major indices such as the Russell 2000 and Van Eck Junior Gold Miners Index. Over 89 institutions own Paramount stock and the stock trades close to 700k shares a day.

There is a large short of 14 million shares who may soon need to look to cover as Paramount is actively advancing the top mining projects in Nevada and Mexico. The shorters will grow increasingly nervous as Paramount may be on the verge of major advancements in both Mexico and Nevada.

Paramount appears to be finding strong support at the $1.25 area at three year lows and what I believe could be a major bottom as the momentum is increasing. Look for a breakout above $1.70 and the 200 day moving average to confirm bullish trend reversal.

Paramount's San Miguel Project already has a Preliminary Economic Assessment which is economic even in today's environment and it is located in the Sierra Madre Belt where there has been a lot of M&A activity over the past couple of years. Paramount may be the next big takeout target.

Check out my recent interview with Paramount Gold and Silver CEO Chris Crupi where we discuss all the recent exploration developments at San Miguel and Sleeper and upcoming catalysts in 2013 by clicking here... or watching the video below.

For More Info on Paramount (PZG) Contact.

Chris Theodossiou, Investor Relations

866-481-2233

Disclosure: I am a shareholder of PZG and they are a sponsor on my website.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see new interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

Please forward this article to a friend. To send feedback or to contact me click here...

Listen to other interviews with movers and shakers in the mining industry below or by clicking here...