This recent correction in gold and silver from record highs has lasted several months. This base building process may be a sign of a more powerful move as many of the weak hands were shaken out. After the next round of QE, it may be too late to move into gold, silver, oil, copper and other tangibles. The geopolitical tensions in the Middle East could further drive up the prices in oil and precious metals. This may be some of the early signs of a flight into commodities and real assets such as rare earths, graphite and uranium.

Read more

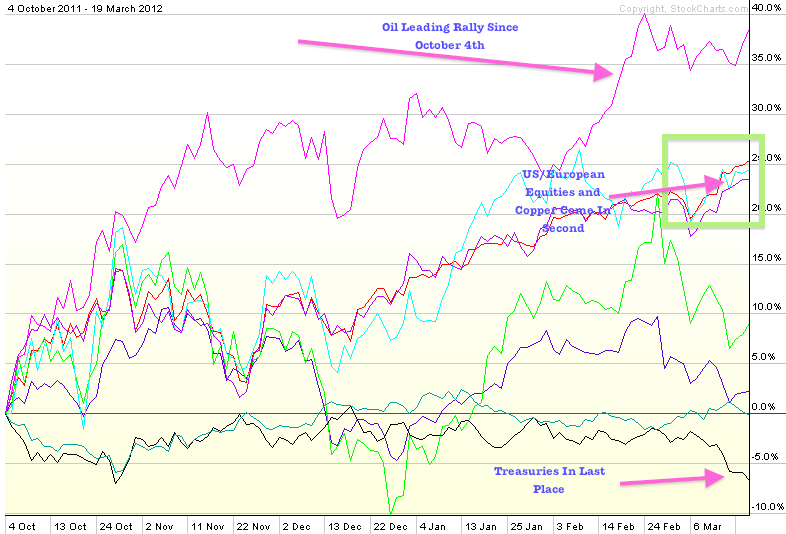

Are We On The Verge Of a Major Rally In Precious Metals and Natural Resources?