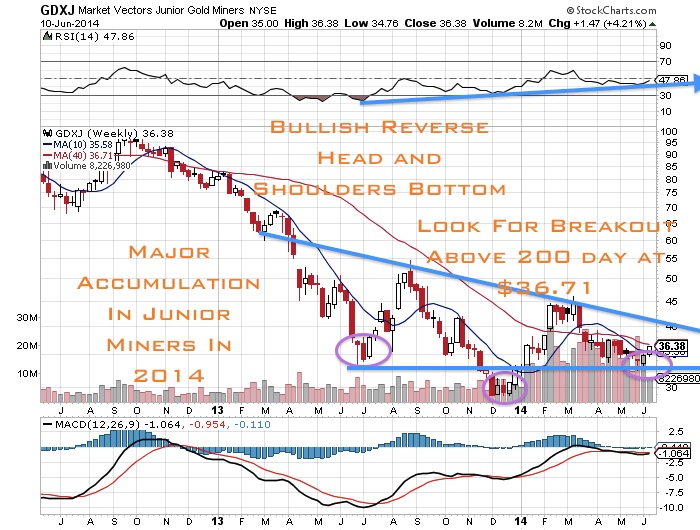

Looking at the chart above notice that even though gold (GLD) has hit new lows, the junior gold miners (GDXJ) are finding support and the Momentum indicators are positive. That may indicate a rebound or at least a relief rally may soon be underway in the junior miners possible following tax loss selling. December tax loss selling is always challenging in the junior markets during good times, how much more so in these historically tough times. The good news is that January is usually rally time for the junior miners as investors reposition for 2016 in beaten down names. I expect that the first three months of 2016 could be exciting for some of the highest quality names with top assets, treasury and management.

Read more

Is Junior Gold Miner Relative Strength Forecasting Powerful Relief Rally in January?