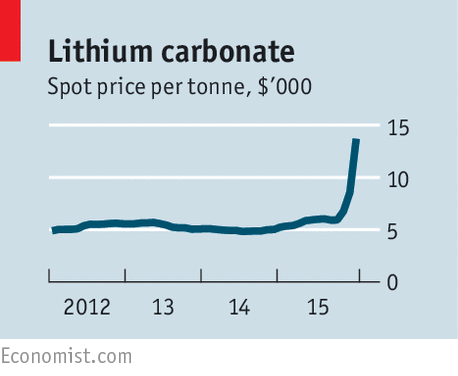

In 2014, something very interesting happened. Despite the bear market in the junior sector, two mining companies, which I'm a shareholder of and which I spoke about numerous times in 2014, led the entire OTCQX. No. 1 was Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX). No. 2 was NioCorp Developments Ltd. (NB:TSX). Western Lithium had a 2,566% increase in daily trading volume in 2014. NioCorp gained 394% in market cap. They were the top two of the best 50 OTCQX® companies. Picking the top 2 out of 10,000 public companies from all over the world during the worst bear market in mining history and an unprecedented stock market bubble has been a great blessing. This is why investors are attracted to the junior mining sector. If you do your homework and pick the stories that have exceptional fundamentals, you can realize exceptional gains. Two gains like that can offset a lot of losses.

Read more