Barrick Gold (ABX), the largest gold miner in the world, came out with earnings that were better than most analysts expected. The market was obviously happy as the large gold miner says it may suspend its high cost projects in questionable jurisdictions. Instead, I have suggested in many articles that Barrick should focus on their Nevada projects which are continuing to support the company with a large amount of positive cash flow. Nevada is the jurisdiction, which made them successful.

On the other hand their $8.5 billion Pascua Lama Project has been a disaster with soaring costs and jurisdictional disagreements. It is an albatross and Barrick must cut their losses. They should look to invest in Nevada where their properties especially in the Cortez Trend have some of the highest margins in the business. Over the past year, Barrick's risky moves into questionable projects and jurisdictions have hammered down its share price. Sometimes well managed juniors may actually be safer than some of the majors.

Remember there are smaller but more efficient junior producers who could compete with the clumsy larger players in terms of its ability to expand their gold and silver production and at the same time reduce costs. Comstock Mining (LODE) is one of the few junior gold miners that is producing gold and generating positive cash flow in a very turbulent and volatile marketplace.

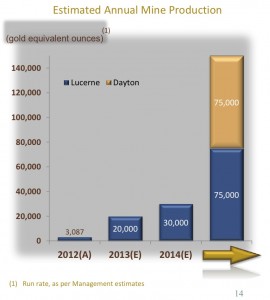

The company is well capitalized to explore and expand the resource around the historic Comstock Lode. In a recent technical report, Comstock Mining announced the discovery of the "Chute Zone" which is similar to the historical bonanza grades found by the old time miners over a 100 years ago. This discovery is very exciting as it could really boost the growth of Comstock Mining, which has been producing gold now for about 8 months. They hope to eventually produce 150,000 ounces of gold per year in 2015.

Comstock is comparing the Chute Zone to the Woodville Bonananza which was mined in the 1870's. Having a strong management team, shareholder base and positive cash flow to explore the eastern slope of the Virginia Range near Reno, Nevada is very exciting.

Comstock Mining has expanded the resource to 2.7 million ounces of gold and close to 27 million ounces of silver. Still, the company believes they are just scratching the surface of the potential in this historic mining district. It is still trading near multi-year lows.

Current production and positive cash flow could internally fund exploration operations providing less dilution risk to current shareholders. The company has recently stated a near term target of 20k ounces of gold and is looking to expand that over the next few years as additional deposits come online.

Finding a growing gold and silver producer that could internally fund resource growth, in a mining friendly jurisdiction, with quality management and strong shareholder support, with the potential to make bonanza style discoveries is not easy to find in today's market environment.

Listen to my recent interview with CEO Corrado DeGasperis from Comstock Mining (LODE). Corrado has over 25 years of manufacturing, mining and capital markets experience. He was the CEO of Barzel Industries and CFO of Graftech International, a global manufacturer of industrial graphite.

Disclosure: Author and interviewer owns Comstock Mining and the company is a sponsor on my website.

___________________________________________________________________________

Sign up for my free newsletter by clicking here…

Sign up for my premium service to see further interviews and reports by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

Accredited investors looking for relevant news click here…

0 Responses