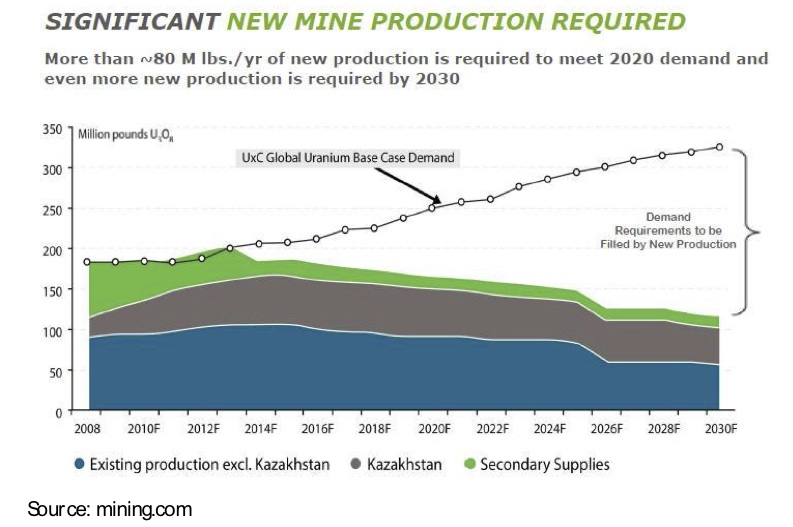

Global miner Rio Tinto announced that there were increasing risks of a supply shortfall in strategic metals. The majors are dealing with the rise of resource nationalism and rising permitting difficulties for new mines. Countries such as China, Indonesia, Namibia and Argentina among others have already expressed that they want a bigger slice of the pie adding export taxes and forex requirements.

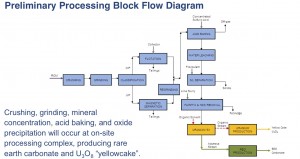

Recently one of our recent rare earth/uranium recommendations Pele Mountain(GEM.V or GOLDF) announced an Updated PEA for its 100% owned Eco Ridge Mine Rare Earths and Uranium Project. The numbers are very compelling especially considering its dual advantage of potentially producing rare earths and uranium at a time where we may witness a supply shortfall in these metals. Already there are uranium mines operating at much lower grades than Eco Ridge's.

With the growing rise of resource nationalism and the supply shortfall in critical rare earths and uranium, Pele's Eco Ridge seems to be a logical choice for majors desperate for new, economic, long life supplies of uranium and critical rare earths. The Ontario Province may see Elliot Lake as a strategic supplier of critical metals and uranium required for cheap and clean energy.

Do not forget over 50% of Ontario's energy comes from nuclear power and they have plans of building an additional nuclear station using the latest generation CANDU nuclear reactors which are able to last up to 120+ years. The Pele's Eco Ridge Mine may be a supplier of domestic uranium and critical rare earths for decades.

Pele Mountain is located in the mining friendly jurisdiction of Elliot Lake, Ontario, Canada and its major project is the Eco Ridge Mine. It is 100% owned by Pele Mountain Resource and possesses an additional kicker in the form of not only being located on a heretofore successful uranium camp but also has a reported wealth of the desirable rare earths.

It should be noted here that recently mining giants in uranium and rare earths are on the record that they are looking to acquire resources that have the dual properties of rare earths and uranium in the same basket. Pele Mountain happens to sit on such a deposit.

Management has just reported an updated PEA which may lead to "larger scale pilot plant operations in the first half of 2012". The updated PEA has optimized and expanded recoveries of the critical rare earths.

The PEA showed a NPV of over $1 billon and the company has a current market cap of less than $20 million.

The PEA showed a NPV of over $1 billon and the company has a current market cap of less than $20 million.

Watch my interview with Al Shefsky, CEO of Pele Mountain discussing the recently released Preliminary Economic Assessment.

Pele is testing a 3 year low, which may be a bottom forming area. The $.10 cent mark has held over the past three years and now the company has published an impressive Preliminary Economic Assessment showing an impressive NPV of over $1 billion. In 2012 we have witnessed some strong accumulation despite hitting new lows indicating that smart investors are realizing that the downside risk is minimal and that there may be a lot of room to the upside.

Disclosure: Long GOLDF and Pele is a featured company on Gold Stock Trades.

To continue to follow new developments in rare earths and uranium click here...