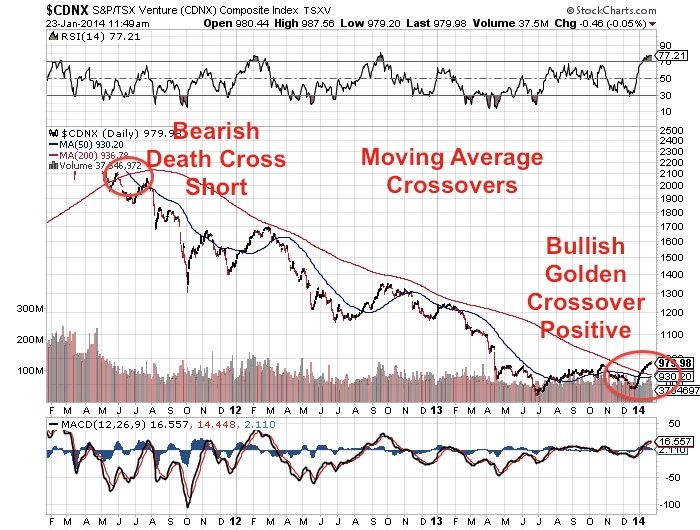

It may seem like a confusing time to be a mining investor, but Jeb Handwerger, of Gold Stock Trades, insists it doesn't take a rocket scientist. "Stick to the fundamentals," he says. "The technicals will eventually reflect the fundamentals." In this interview withThe Mining Report from early December, Handwerger talks about what companies have the right foundation to shine after the market dusts itself off and starts to climb. As Jeb said in the interview, "Some people are thinking about leaving the sector. That's not the right approach. Gains could be exponential in the coming weeks. The right approach is to rotate into situations that will outperform, even if gold and silver stay flat. Stick to advisors who are finding the most compelling situations. Corrections take longer than people expect—the longer and the deeper the base, the more powerful the eventual upswing. It could be huge with the record amount of cash on the sidelines and the large number of shorts who may need to cover their position." Since this interview was published the Venture Index has jumped close to 100 points and broke the 200 day moving average.

Read more