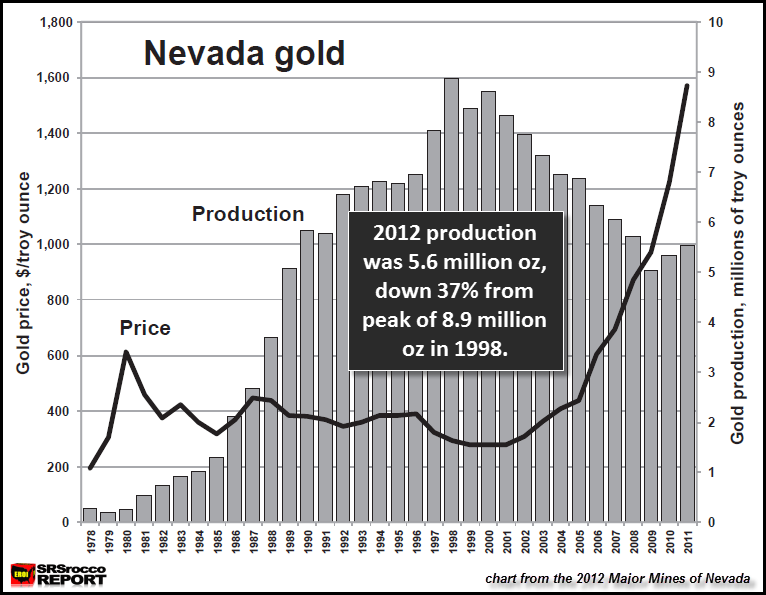

During this gold correction, miners needed to focus on lower cost targets. For Barrick and Newmont their Nevada gold production has the lowest cash costs in the world and are much less risky politically than mines in other locations. Newmont paid high prices for Fronteer Gold (FRG) back in 2011, which I owned and recommended to my subscribers back in 2010 for its Long Canyon deposit located in Nevada. Discoveries in Nevada fetch a high premium compared to assets in more hostile places. Here is another discovery to pay attention to...

Read more

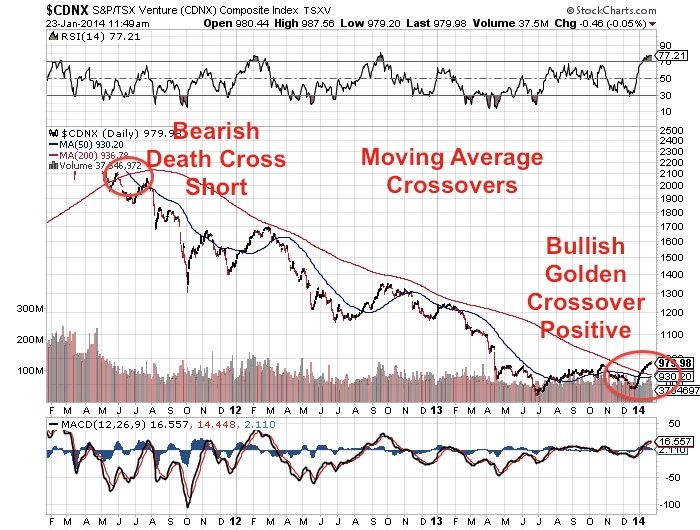

Time To Buy The Junior Gold Miners in Nevada?