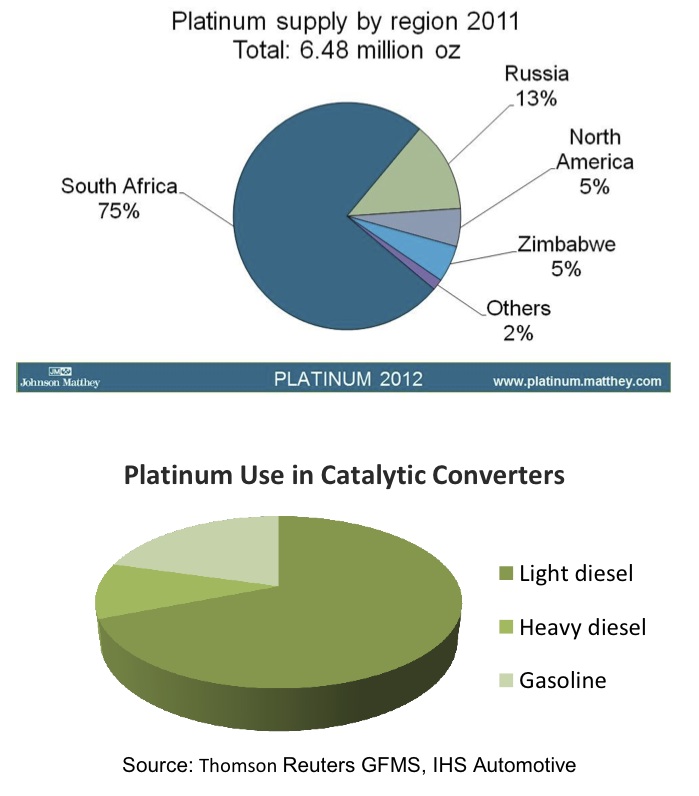

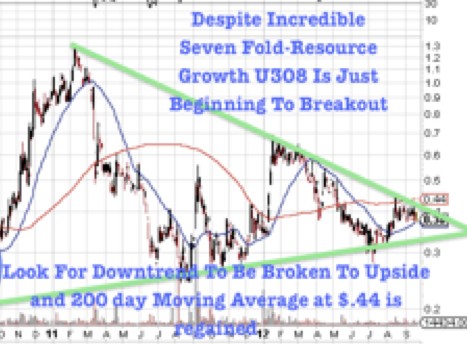

Gold and silver are good investments to hedge against the coming hyper-inflation but a couple of weeks ago we told our readers that platinum may soar more. One company is making rapid progress and has strengthened its management team this November to move forward to production. This is a major achievement for this platinum company to attract this type of management talent with proven experience. They now may have the capability to build and successfully operate the next major nickel-PGM in North America. As the CEO stated in their most recent news release, "...we are putting in place a highly experienced management team to advance the development of the world class PGM-Cu-Ni project in the Yukon.”

Read more

New Management Team Assembled To Advance World Class Platinum Discovery