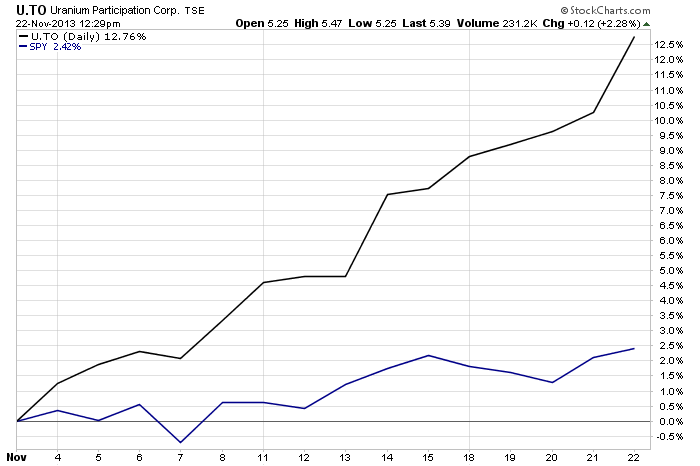

Similar to Peyton Manning and Joe Montana, uranium is making a great fourth quarter comeback after many fans have already left the stadium. As predicted, Uranium Participation is outperforming the S&P500 in November up over 13% while the S&P500 makes a 2.5% move. Watch these three junior uranium mining stocks as we end 2013. Some are already making major breakouts. We may be watching a great fourth quarter comeback in some of these high quality junior mining shares.

Read more

Uranium Price Makes Fourth Quarter Comeback Surprise