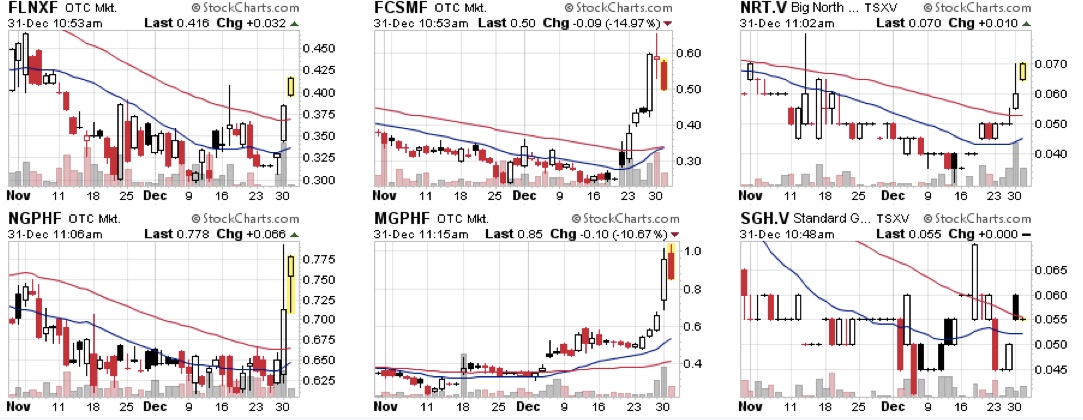

For many months, I highlighted the rising demand for precious metals from investors looking to diversify away from declining fiat currencies most notably out of Chinese and Indian investors. The new Fed Chair Yellen may be sparking off an inflationary rally as gold and silver appear to breaking above key technical levels. At the end of 2013, mostly no one wanted to own gold and silver bullion and definitely didn’t want the junior gold and silver miners as the price of gold declined from $1900 to below $1200 and silver declined from $50 to below $19. I called it a historic holiday discount buying season. Many who believed prices would continue lower and shorted may now be covering as gold and silver breakout and regain the 200 day moving averages and hit new four month highs.

Read more

Gold-Silver Producer In Nevada Outperforming Peers