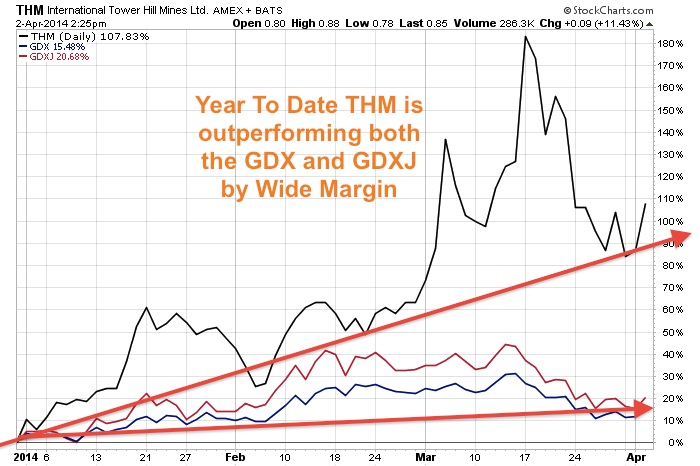

Weeks ago I forecasted black swans on the horizon that will wake investors from their summer doldrums. I warned you about the Russian-Ukraine crisis, the rise of ISIS in Iraq and a potential war between Hamas and Israel. The junior gold miners (GDXJ) and silver miners (SIL) are on the verge of a major reverse head and shoulders breakout. Look for GDXJ to breakout through $46 and the silver miners (SIL) to break through resistance at $14.75. The copper miners (COPX) have made a major rally from $8.60 in March to $11 in July. I expected this pullback before a September Labor Day Rally. I believe the summer doldrums may be ending and we may be on the verge of beginning of a major rally. Investors may want to look into this junior miner which hit 412m of 1.4% copper equivalent in a gold-copper porphyry.

Read more

Summer Doldrums in Junior Gold Miners Ending?