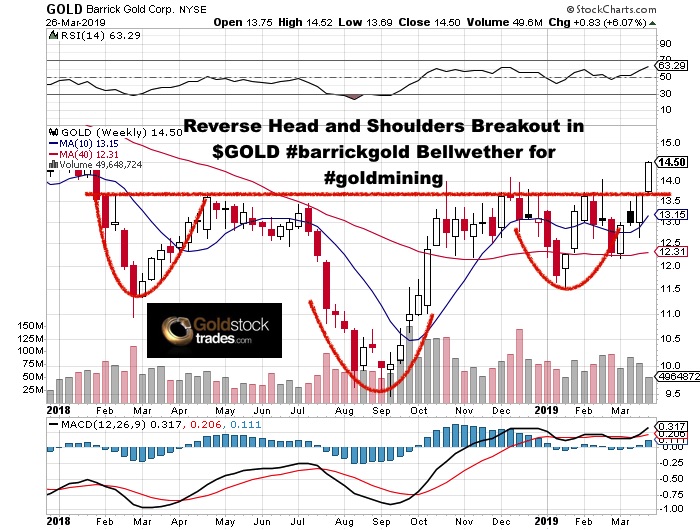

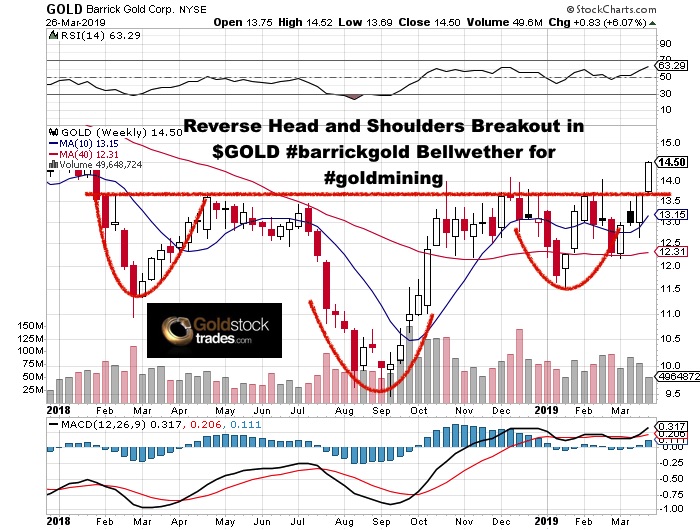

Gold could be about to breakout into new 10 year highs when looking at in Canadian dollars and top gold explorers in the best mining jurisdictions will come back into favor as the producers can not replace their reserves. Stick to teams with track records like this team in Nevada. It starts life as an attractive explorer with a proven exploration team, a portfolio of promising targets in mining-friendly jurisdictions, and ~$4 million in cash. Its shares are heading to 90 cents, Beacon Securities said. Its currently trading at more than half off that below 45 cents.

Read more