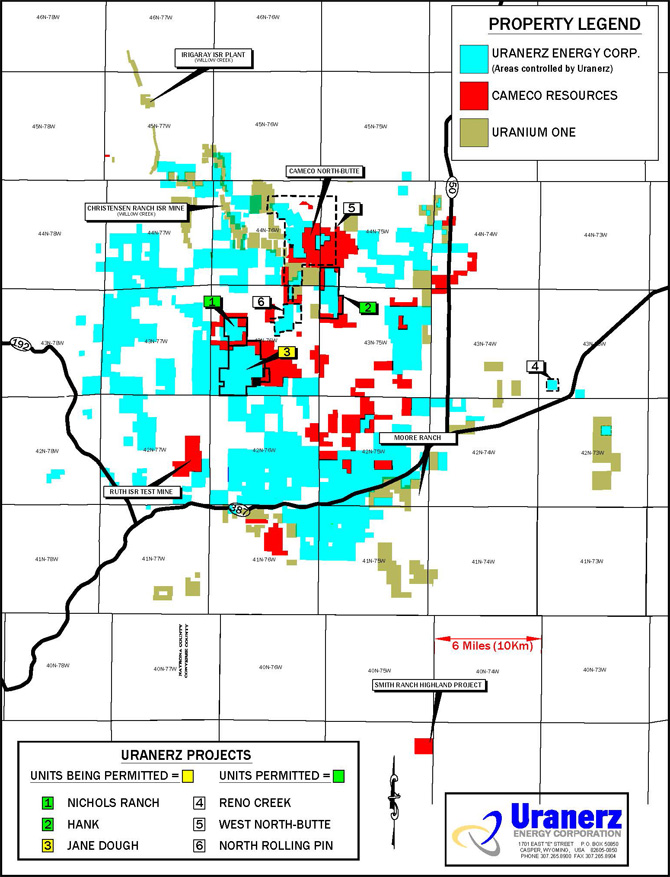

Uranerz is positioned to become America’s next uranium producer and is the rare gem that is poised on the cusp of providing near term rewards. In the interest of time and space, it should suffice that we have researched this company and hasten to bring it to your attention. Production is slated to begin in 2012.

Today Uranerz reported that it continues to receive good uranium grades in holes drilled for well-field installation. The recent hole was the best hole ever drilled by the Company.

Read more

Uranerz Energy (URZ): “Best Hole Ever Drilled By Company”