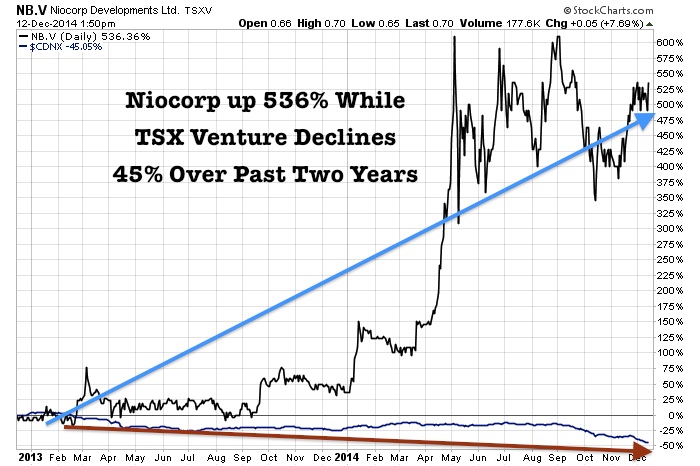

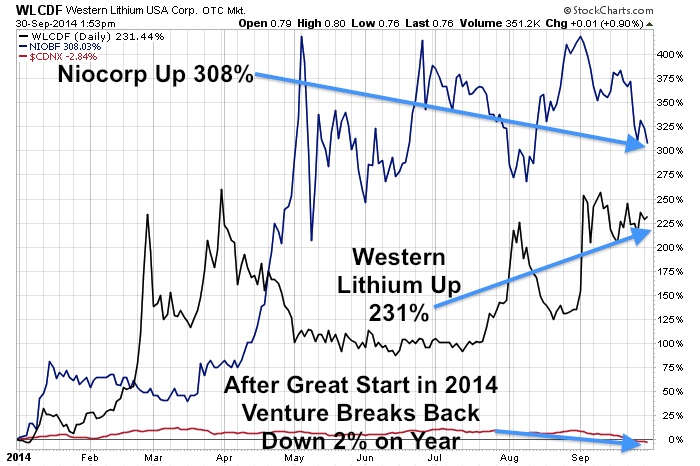

Niocorp (NB.TO or NIOBF) has had an impressive year finishing a major three phase drilling program demonstrating to the investment community that Elk Creek is a world class high grade and large niobium resource. Niocorp recently announced some economics in the Preliminary Economic Assessment (PEA). The 311 page report can be read by clicking here. Despite a four month correction all the way below the 200 day moving average, the stock may bounce higher as momentum is improving. The MACD is rising and the stock has broken above the critical 50 mark on the RSI. What might intelligent investors be reconsidering in this PEA to start once again buying Niocorp?

Read more

Niocorp’s Nebraska Niobium Deposit Could Generate Cash Flow For Over Three Decades