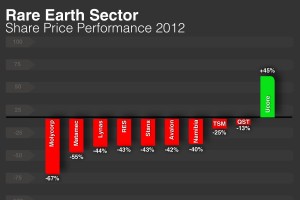

Ucore was possibly the only rare earth miner which was up in 2012 while the entire sector declined. Ucore was up 45%, while Molycorp was down 67%. This relative strength is remarkable and may be forecasting outperformance if the sector should rebound.

It must be noted that Ucore has the highest grade heavy rare asset in the United States with a low capex cost. They have the support of the U.S. Department of Defense and the State of Alaska. They are using U.S. cutting edge chemistry called Solid Phase Extraction to separate the dysprosium. All these positives may be indicating that Ucore may be leading the race to U.S. heavy rare earth production so critical to our national survival.

The chart shows major accumulation in 2012. Observe the bullish MACD crossover, cup and handle and symmetrical triangle pattern all historically indicative of a major breakout.

I recently recorded an interview with Jim Mckenzie CEO of Ucore Rare Metals (UCU.V or UURAF) on the top ten advantages of Bokan Mountain compared to others in the rare earth sector. Make sure to listen.

Disclosure: Author and Interviewer owns Ucore and Ucore is a sponsor on our free website. We are offering ideas for your consideration and education. We are not offering financial advice. None of our content is provided to invite or encourage any person to make any kind of investment decision. We are not financial advisors. We advise you to consult with a professional financial and investment advisor before relying on any content. Please do your own due diligence!

Companies may become sponsors on Gold Stock Trades and/or our free or affiliate websites or radio programs for public relations consulting for a monthly fee and/or options. From time to time, Gold Stock Trades and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise. Please see our list of current sponsors and featured companies for any potential conflicts of interest.Some information in our content can be construed as forward-looking statements. Forward looking statements are uncertain and actual results may differ from our expectations. We seek safe harbor. Some companies discussed may not be registered in the United States.

0 Responses