One company that we recommended in July has seen a huge increase of institutional interest and analyst coverage has been initiated. The company has also graduated to the TSX from the Venture Exchange demonstrating its rapid growth from a small junior to a mid-tier uranium mine developer. This multi-commodity project will gain further awareness as it announces its Preliminary Economic Assessment by year end 2012 and move into Feasibility.

Read more

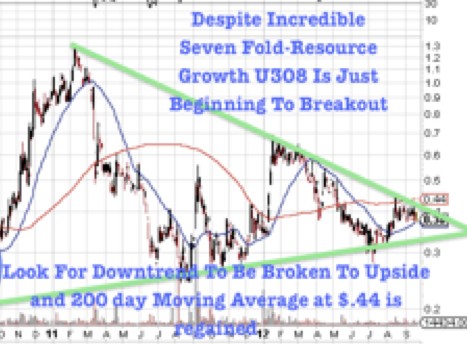

Major Capital Accumulating This Fast Growing Uranium Miner In Colombia